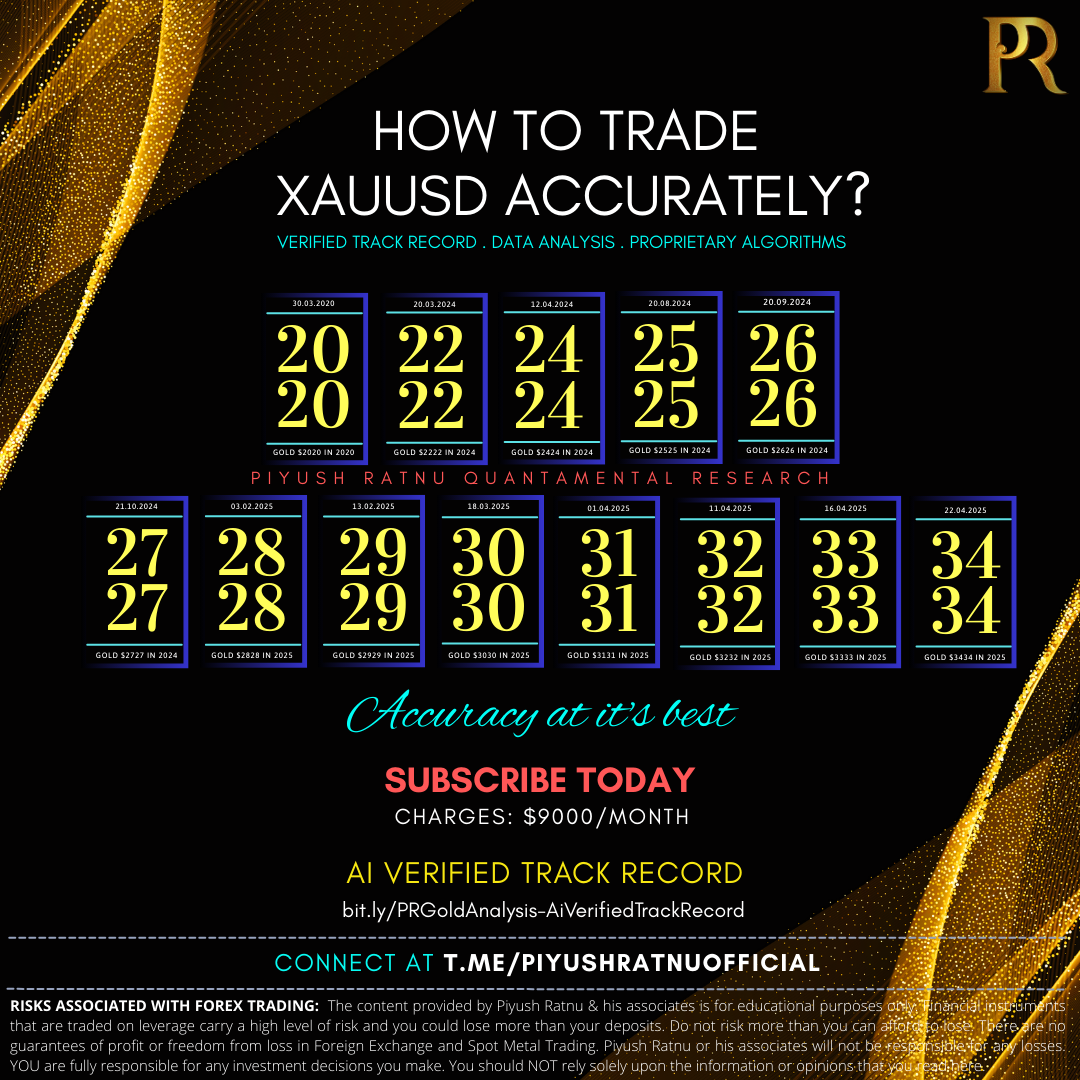

How to trade XAUUSD Spot Gold accurately on NonFarm Payrolls Day in May 2025?

XAUUSD Spot Gold: $3131/3030 or $3434/3535 after NonFarm Payrolls Data?

Gold price (XAU/USD) attracts some dip-buyers during the Asian session on Friday and looks to build on the overnight bounce from the $3,200 neighborhood, or over a two-week low. The uptick could be attributed to some repositioning trade ahead of the release of the closely-watched US Nonfarm Payrolls (NFP) report later today.

The crucial jobs data could provide a fresh insight into the Federal Reserve’s (Fed) policy outlook, which, in turn, will play a key role in influencing the near-term US Dollar (USD) price dynamics and provide a fresh impetus to the non-yielding yellow metal.

US-China

Heading into the key data risk, signs of a potential de-escalation in the trade war between the US and China – the world’s two largest economies – might continue to act as a headwind for the safe-haven Gold price.

It will be wise to wait for strong follow-through buying before confirming that the XAU/USD pair’s corrective slide from the $3,500 mark, or the all-time peak has run its course and positioning for any further gains.

Key Factors impacting Spot Gold XAUUSD Price:

- China’s Commerce Ministry said on Friday that the US has recently, through relevant channels, actively conveyed messages to engage in talks on tariff issues and the country is assessing the proposal to start negotiations. This adds to the optimism over a possible easing of the tit-for-tat tariff war between the world’s two largest economies.

- Moreover, hopes for tariff deals between the US and its trading partners lifted the US Dollar to a three-week high and dragged the Gold price to the $3,200 neighborhood on Thursday. The USD bulls, however, turn cautious amid bets for more aggressive policy easing by the Federal Reserve and ahead of the US Nonfarm Payrolls report.

- Traders ramped up their bets that the US central bank will deliver four quarter-point rate reductions by the year-end after data released this week showed that the US economy unexpectedly contracted for the first time since 2022. Moreover, the Personal Consumption and Expenditure (PCE) Price Index pointed to signs of easing inflation.

- Adding to this, the US ADP report on private-sector employment suggested that the US labor market is cooling. Furthermore, the US Department of Labor reported on Thursday that initial jobless claims increased from 223,000 to 241,000 in the week ended April 26 – marking the highest level since February.

- Meanwhile, the US ISM Manufacturing PMI remained firmly in contraction territory for the second straight month, though it fell less than expected, from 49.0 to 48.7 in April. Traders now look forward to the release of the US monthly employment details for fresh cues about the Fed’s policy outlook.

- The popularly known US Nonfarm Payrolls (NFP) report is expected to show that the economy added 130K new jobs in April, sharply lower than 228K in the previous month. The Unemployment Rate, however, is expected to hold steady at 4.2%, while Average Hourly Earnings might have risen by 0.3%.

How to trade XAUUSD on Non-Farm Payrolls Day?

- Do not open aposition as soon as NFP Data is released

- +NFP = USD+ XAUUSD – | and vice versa

- Only one rule – Anything is possible, hence avoid overconfidence

- Observe SR Zones, before opening a trade

- Wait for 20 min / $30/15/15 price gaps

- Exit the trade in Net Average Profit

- Open positions only as per D1 PRSRZ

- Keep in mind the price zones as per W1

- Set Price Grid Gap as $30 | Enter at bottom/high of grid only

- Start your first trade with 0.01, always | then enter 5x, 10x at price zones

Golden Ratio based money management should not be used at least till $30 price movement in any direction, do not implement Sequential or Repetitive Martingale strategy on NFP Day.

Ideal Settings for major indicators on NFP:

RSI: 14, 80/20 M15, H1

SOC: 9,5,5 M30, H1

CC1: 18 M15,H1

———————————————————————————-