Key Fundamentals & EVENTS IMPACTING SPOT GOLD in DECEMBER 2023:

- FOMC MEETING Preview: The Federal Reserve will hold the federal funds rate unchanged at 5.25%–5.50% at next week’s Federal Open Market Committee (FOMC) meeting. That much we know. What is less certain is how officials will communicate their policy intentions, how much lower their inflation projections will be revised, how smooth of a soft-landing they expect, and how many rate cuts will be featured in the new “dot plot” of median rate expectations.

Despite a string of positive indicators recently regarding prices, the central bank leader said the Federal Open Market Committee plans on “keeping policy restrictive” until policymakers are convinced that inflation is heading solidly back to 2%. “It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease, Powell said in a speech. However, the remarks gave some credence to the idea that the Fed at least is done hiking as the string of rate hikes since March 2022 have cut into economic activity and also he mentioned that inflation “is moving in right direction”.

After inflation hit its highest level since the early 1980s, the Fed enacted a series of 11 interest rate hikes, taking its policy rate to the highest in 22 years at a target range between 5.25%-5.5%. The FOMC at its past two meetings kept rates level, and multiple officials have indicated they think the federal funds rate is probably at or near where it needs to be. The Fed’s next meeting is on 13th December 2023.

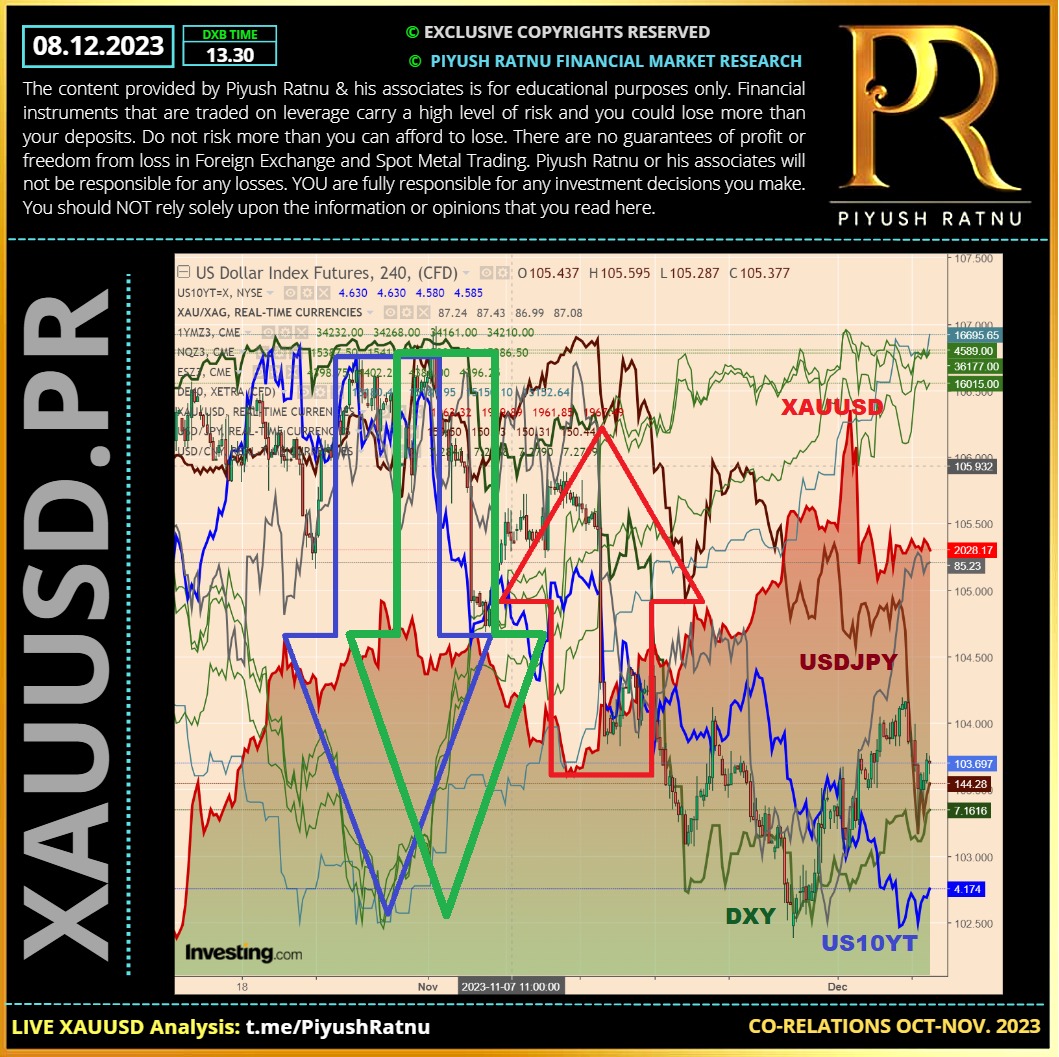

- Yen: Bank of Japan Gov. Kazuo Ueda met Prime Minister Fumio Kishida on Thursday to explain monetary policy, ahead of the central bank’s next decision later this month, as speculation continues to simmer over the likelihood of near-term policy moves.The remarks contributed to a roughly 12-basis-point rise in the yield on 10-year Japanese government bonds. Markets are now implying a roughly 35% chance that the central bank will end its negative interest rate policy at the next policy meeting on 19 December. The yield on the 10-year US Treasury initially rose around 7 basis points to 4.17%, interrupting a strong decline over recent weeks, though the yield later fell back to 4.14%. The rise was based on the assumption among many investors that Japan’s easy monetary policy exerts downward pressure on global yields.

Long-term yields in Japan reached highs not seen in a decade, with the central bank further relaxing its yield curve control (YCC) policy and the yen briefly depreciating to its lowest level since 1990. Bond spreads temporarily widened within the euro area on country-specific fiscal concerns. As a result, we see the latest comments as consistent with our view that the BoJ would cease efforts to control the yield curve in the first quarter of 2024 and would end negative interest rates in the second quarter. We still expect the central bank to maintain a dovish tone, to avoid a sharp spike in bond yields. In addition, we don’t believe Japanese policy has been the anchor on global rates that some investors assume, and so we don’t expect a major spillover to global markets as Japan’s rates rise.

USDJPY: USDJPY experienced flash crash in December 2023, falling by 3.8%, as a result we observed a price crash in USDJPY from 147.400 – 141.700 in 15 trading hours.

- CHINA: The risks from China’s debt pile are mounting as the country grapples with an economic slowdown and property crisis, The country has signalled plans to ramp up stimulus spending, as it battles soaring youth unemployment, weaker global demand hitting its manufacturing industry and deepening woes in the property sector.

After decades of seeing its economy expand by more than 8% a year, China is on track to grow by 5.4% this year. However, growth is likely to slow to 3.5% by 2028, according to a forecast from the International Monetary Fund.

“It is expected that next year China will continue to implement positive fiscal policy, monetary policies that are in line with positive fiscal policy, with a relatively large policy space to lower the reserve requirement ratio, With interest rates and loan prime rates at low levels, there is more space to cut banks’ reserve requirement ratio (RRR) than to cut interest rates, The central bank lowered the RRR in September for the second time this year to boost liquidity and support economic recovery. Analysts expect another cut by year-end. The weighted average RRR for financial institutions was around 7.4% after the cut. China is prudent in cutting interest rates as its monetary policy needs to consider internal and external balance.

- ECB: In recent weeks, sovereign bond yields across the eurozone have experienced a significant downward trend, propelled by mounting market anticipation of forthcoming rate cuts by the European Central Bank (ECB) in 2024. As inflationary pressures in the euro area continue to ease – with November’s annual inflation rate at 2.4%, the lowest since July 2021 and well below expectations of 2.7% – and retail sales data for October indicating a slowdown, the market is pre-emptively betting on a significant shift in the ECB’s monetary policy in 2024.

Only two months ago, money markets were predicting a 60-basis-point reduction in ECB interest rates for 2024, equivalent to two fully priced 25-basis-point cuts. However, the landscape has undergone a significant transformation, with markets currently anticipating an initial rate cut as early as March. They are now factoring in a total reduction of 144 basis points by December 2024, with cumulative five cuts already priced into their forecasts.

- US 10 Year Yield: The 10-year U.S. Treasury yield slid on Wednesday as investors assessed the state of the economy after the release of labor market data while awaiting a key report due Friday. The yield on the 10-year Treasury dipped by more than 5 basis points to 4.117%. That pushed the yield to a new low going back to early September.

- WGC: Global gold ETFs outflows slowed significantly in November supported by net inflows into North American funds. Geopolitical risk and investor positioning helped push gold higher in the month, contributing to the change in trend in the US. So far in 2023, collective holdings of global gold ETFs are down by 7%, while total assets under management (AUM) saw a 5% increase amid a higher gold price. Global physically backed gold ETFs saw a small outflow of US$920mn in the month, significantly narrower than the previous month.2 Holdings lowered to 3,236t, a 9t decline in November, while total AUM rose by 2% to US$212bn, supported by a meaningful 2% rise in the gold price. In North America, surging Treasury yields between June and October drove outflows of (-US$9bn) during that period, which outweighed inflows of US$4bn during the rest of the year (+US$4bn). And during the past 11 months, European funds’ outflows piled up to US$9bn, the worst of all regions, also driven by rising interest rates in Europe, which diverted investors’ attention away from gold. Germany and the UK led the region’s y-t-d outflows. Asia remains the only region experiencing y-t-d inflows (+US$1bn), thanks to China, Japan and India. Accumulated outflows from the Other region reached -US$103mn y-t-d: inflows into Turkey were outweighed by outflows elsewhere.

- US Data: The US ISM Services PMI exceeded expectations; JOLTS Job Openings declined to their lowest level since March 2021 Productivity, or output per hour, revved higher by 5.2% for the same period, compared to the 4.7% initial estimate in November and the 4.9% Dow Jones expectation. Meanwhile, traders got another sign of job market cooling on Wednesday, as ADP data also came in below forecasts. Private payrolls increased by 103,000 in November, under the Dow Jones estimate of 128,000. Treasury yields fell on Tuesday after JOLTs job openings figures for October came in lower than expected and indicated a cooling of the labor market — 8.73 million openings were recorded, a drop of 617,000 and far below the 9.4 million.

- UPCOMING IMPORTANT INTEREST RATE EVENTS IN December, 2023 :

- FED – 13th December, 2023

- ECB – 14th December, 2023

- BOE – 14th December, 2023

- BOJ – 19th December, 2023

Figure 1: XAUUSD Co-relations | Oct.-Nov. 2023 | Piyush Ratnu Market Research

Figure 1: XAUUSD Co-relations | Oct.-Nov. 2023 | Piyush Ratnu Market Research

How to trade Spot Gold: XAUUSD on NFP data today?

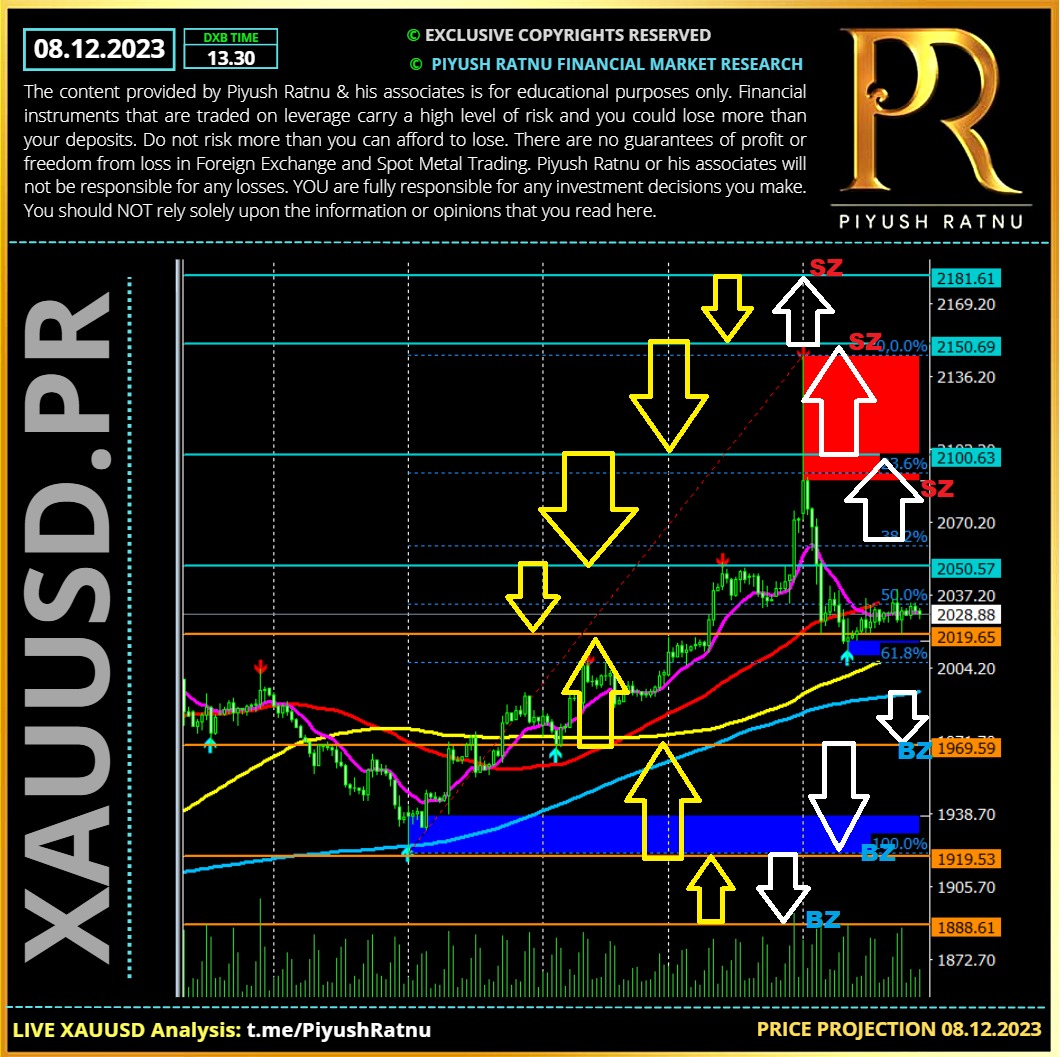

XAUUSD Bearish Scenario: $1985/1966/1947/1926?

If the bearish momentum pushes XAUUSD price below $1996, Spot Gold price may fall further towards $1947/1926 price trap zone as next stops, if Gold crash halts at $1926 or $1907 zones a reversal can be expected with a RT V 23.6 M15 M30 RT before/in next 15 trading days.

XAUUSD Bullish Scenario: $2048/2069/2096/2121?

If the Bullish momentum pushes Gold price across 2075 barrier, XAUUSD price might march towards $2096/2111/2121, opening way to $2145/2169 zone as an ideal sell entry. An unexpected BLACK SWAN event/ New Year Holiday season based low volumes / opening session based high volumes / geo-political tensions based upward price movement in Spot Gold cannot be ruled out. It will be wise to avoid PPZ/price trap zones.

Heading into the NFP show today, Spot Gold price is under a price trap of $2020 zone. In current scenario, & as per past data fundamentals-based co-relations have guided us in a more accurate manner than technical co-relations, however I prefer to compare and match both for a better accuracy.

BUY/SELL STOPS |WEEKLY B/S MNSR LIMITS: TARGET RT 23.6 TF H4 | NAP $15/set:

S2 ZONE 2009 | DOWN TREND (Below $1996) : $1966/1947/1926/1907/1888 | BUY LIMITS

R2 ZONE 2111| UP TREND (Above $2075) : $2069/2096/2121/2145/2169| SELL LIMITS

Technical Analysis | XAUUSD CMP $2027 | Gold Price – SR (D1) (MN) Levels to watch:

| SR ZONES D1 | |

| R1 | 2032 |

| R2 | 2044 |

| R3 | 2056 |

| R4 | 2064 |

| R5 | 2076 |

| S1 | 2024 |

| S2 | 2012 |

| S3 | 2000 |

| S4 | 1992 |

| S5 | 1980 |

| SR ZONES MN | |

| R1 | 2051 |

| R2 | 2101 |

| R3 | 2151 |

| R4 | 2182 |

| R5 | 2232 |

| S1 | 2020 |

| S2 | 1970 |

| S3 | 1920 |

| S4 | 1889 |

| S5 | 1839 |

08.12.2023 | XAUUSD: Monthly Price Projection and Trading Scenario by Piyush Ratnu

Figure 2: Trading Scenarios: SR-MN PRSDBS MTD FIB RT TF H4 | Price Projection by Piyush Ratnu

PROJECTED TRADING SCENARIO:

- Observe price at US OPENING D1 SS1 and then US SS2

- Observe D1 PRSRLVL S3/R3 set +3/6/9/12 for M15/30.236RT

- Do not enter between the pivot zone D1: S/R zones

- Observe D1SR: FIB 23.6% on M5 and M15/M39 TF for NAP target price based exit in buy or sell entry after 15/45/60/90 minutes of NFP and $25/40 price movement sets

- Movement of $35/60 dollars on Gold price is not something unexpected nowadays.

Note: A surprise on Monday during early trading hours cannot be ruled out too, so closing all positions today in net average profit is always the best trading strategy for every trader who wants to safeguard his principal.

I expect a pattern on M30, H1 and H4 TF chart in sequence in next 9 trading days (short term target) and 18 trading days (long term target). XAUUSD CMP $2027.

Point to be noted: let us not forget ongoing geo-political tensions which can trigger an upward price rally of more than $150/200 in Spot Gold price. Another catalyst of low volumes might step in too during Monday early morning opening. Last year, in 2022: we had observed a crash in Gold price from $1728-1615, which was also recorded as the lowest trading price.

Terms: TF: Time Frame | RT: Retracement | SR: Support Resistance | NAP: Net Average Profit

It is always wise to first PLAN THE TRADE, and then TRADE THE PLAN!

Hence, it is suggested to first observe the crash or rise with specific zones and levels in mind on the basis of various fundamental and technical parameters mentioned above, before entering a trade in a specific direction with a target of net average profit in a specific set of trades.

WARNING: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The author will not be held responsible for information that is found at the end of links posted on this page. The author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. The author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author is not a registered investment advisor and nothing in this article is intended to be investment advice. All performance information reflects past performance and is presented on a total return basis. Past performance is no guarantee of future results. Current performance may differ from the performance shown.

RISK WARNING | DISCLAIMER

Information on this Channel/Page contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Information or opinions provided by us should not be used for investment advice and do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. When making a decision about your investments, you should seek the advice of a professional financial adviser.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

The analysis and trading suggestions published by Piyush Ratnu does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Piyush Ratnu does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Piyush Ratnu shall not be responsible under any circumstances for the consequences of such activities. Piyush Ratnu and its affiliates, in no event, be liable to users or any third parties for any consequential damages or losses in any direct or indirect manner, however arising, including but not limited to damages caused by negligence or Force Majeure whether such damages were foreseen or unforeseen.

The capital value of units in the fund can fluctuate and the price of units can go down as well as up and is not guaranteed. You should not buy a warrant unless you are prepared to sustain a total loss of the money you have invested plus any commission or other transaction charges. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals. The high degree of leverage can work against you as well as for you hence implement risk management and money management strictly to safeguard your investment. Do not risk more than .10% of your principle amount in a single trade set.

Before deciding to invest in foreign exchange or other markets you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some, or all, of your initial investment. Therefore, you should not invest money that you cannot afford to lose. In some cases, it is possible to lose more than your initial investment as it is not always possible to exit a market at the price you intend upon doing so. There are also risks associated with utilizing an Internet-based trade execution software application including, but not limited to, the failure of hardware and software. You should be aware of all the risks associated with investing in foreign exchange, indices and commodities and seek advice from an independent financial advisor if you have any doubts.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

FAKE SOCIAL MEDIA ACCOUNTS BY SCAMMERS IMPERSONATING AS PIYUSH RATNU OR HIS ASSOCIATES | DISCLAIMER

Piyush Ratnu or his associates will never ask for credit card/debit card/account passwords/payments in crypto/digital currency for multiplication/duplication through or for trading or any format of investments. Kindly do not engage with any person(s) impersonating as Piyush Ratnu or his team member on social media platforms/email/WhatsApp/SMS. Kindly check our verified social media /group handles on Telegram (T.me/PiyushRatnu) and Twitter (www.twitter.com/piyushratnu) to contact us or email us at info@piyushratnu.com only. Kindly always verify the facts/claims/analysis track record face to face only with Piyush Ratnu or his associate(s) personally. In case you engage/pay/transact with any third party who is not associated with Piyush Ratnu or his associates in such case you and solely you will be responsible for any losses faced due to such engagement/transaction/communication done by you solely at your own risk.

Piyush Ratnu or his associates will not accept any liability for any loss or damage, including but without limitation to, any financial, emotional loss, which may arise directly or indirectly due to your decision. If you do not agree to the above terms, conditions and disclaimer YOU MUST close this page and YOU MUST not act as per the information provided.