How to trade GOLD | XAUUSD accurately on Non Farm Payrolls Day?

Here is my GOLD PRICE ANALYSIS on Non-Farm Payrolls Data Day: Gold was hit hard on the back of a spike in US Treasury yields and the lingering anticipation around the Federal Reserve’s telegraphed interest rate hike in March. Not only that, the Bank of England and the European Central Banks are firming up on their own monetary policy which is raising the opportunity cost of holding non-yielding bullion. However, besides the hawkishness at central banks, the US dollar has come unstuck this week from the Fed-bid. Instead, it has been sold heavily following less hawkish remarks at the start of the week from a chorus of Fed officials, weaker jobs data and a slide in ISM services from the prior month. Risk appetite has also come crawling back into global markets, consequently weighing on the greenback that fell below 95.300 DXY on Friday.

KEY FUNDAMENTAL HIGHLIGHTS

- Fed’s Bullard sees three successive hikes to start policy tightening

- Fed’s Harker says four rate hikes are appropriate for this year

- Economists expect an increase of 150,000 jobs in January.

- White House Warns Latest Jobs Data Will Be Ugly Due to Omicron

- Omicron-related disruptions have likely lowered expectations further.

- A positive figure will remind investors of the Fed’s hawkish stance.

- ECB: Lagarde: ECB would assess condition very carefully and be data dependent.

- Hawkish BoE and ECB prompted some intraday selling around gold on Thursday.

- Weaker USD, a steep fall in the US equity markets helped reverse the early slide.

U.S. job openings rose unexpectedly in December while quits declined slightly, suggesting that labour demand held steady in the month despite a surge in Covid-19 infections and pandemic-related business disruptions. The number of available positions rose to 10.9 million from an upwardly revised 10.8 million in November, the Labour Department’s Job Openings and Labour Turnover Survey, or JOLTS, showed Tuesday. The figure exceeded all estimates in a Bloomberg survey of economists.

The quits rate was little changed at 2.9% from a record 3% in the prior month, pointing to a high degree of churn in the labour market. The level of quits edged down from an all-time high in November. Total hires decreased in December to 6.3 million, driven by professional and business services. The hires rate fell slightly to 4.2%, the first decline in four months. Layoffs and discharges were little changed at 1.2 million. It may be appropriate for the Federal Reserve to raise interest rates four times this year, and to move more aggressively if the factors leading to higher inflation, such as supply chain issues, are not mitigated, Philadelphia Fed President Patrick Harker said on Tuesday.

“Right now, I think four 25-basis-point increases this year is appropriate,” Harker said during an interview with Bloomberg TV. “But there’s a lot of risk here,” including the risk that inflation is worse than expected, or that it eases faster than Fed officials expect, he said. Policymakers say they plan to raise interest rates in March, and to start reducing the Fed’s balance sheet later this year, as they work to remove the accommodation provided to stabilize markets and the economy during the pandemic. “If inflation stays where it is right now and continues to start to come down, I don’t see a 50-basis-point increase,” said Harker, who votes for policy this year as an alternate for the Boston Fed. “But if we see a spike, then I think we might have to act more aggressively.”

U.S. high yield bond ETFs see record outflows in January

U.S. high yield bond exchange-traded funds saw record monthly outflows in January as investors ditched assets likely to be hit by an increase in market volatility and aggressive rate rises by the Federal Reserve.

ECB

The ECB held on Thursday, comments from ECB president Christine Lagarde opened the door to market speculation for a tightening of its monetary policy. Lagarde acknowledged that inflation was running hotter than expected and with risks tilted to the upside. When she was questioned over whether the ECB was “very unlikely” to raise rates this year, Lagarde said it would assess conditions very carefully and be “data-dependent”. This leaves March as a key meeting where the ECB could signal an even more hawkish stance. Meanwhile, the Bank of England raised interest rates to 0.5% and nearly half its policymakers wanted a more significant increase to contain rampant price pressures.

BOE

The Bank of England raised interest rates to 0.5% and nearly half its policymakers wanted a more significant increase to contain rampant price pressures. This too has weighed the DXY down. GBP makes up 11.9% of the index. However, besides the hawkishness at central banks, the US dollar has come unstuck this week from the Fed-bid.

KEY FUNDAMENTAL SUMMARY: How to trade GOLD | XAUUSD on Non Farm Payrolls Day?

I expect the US central bank to look past recent weakness as being related to Omicron’s fallout, which suggests the precious metals complex will remain under pressure. Indeed, quantitative easing has influenced all asset prices by boosting liquidity premiums, which ignites fears that quantitative tightening will particularly weigh on asset prices including gold in the next few months.

Several Fed officials have already made clear that they will discount weak data (indicating in advance the weak data, may be to dilute the impact and boost the risk appetite or may be preparing grounds for a surprise resulting in panic trading) as temporary. Also, we see upside risk on average hourly earnings, with an already strong trend likely to be added to by temporary Omicron effects relating to the composition of payrolls and the length of the workweek. Also, there is room for a positive surprise. Any positive number would likely trigger an “it could have been worse” reaction, boosting the dollar and a reminder that the Fed plans a rate hike in March.

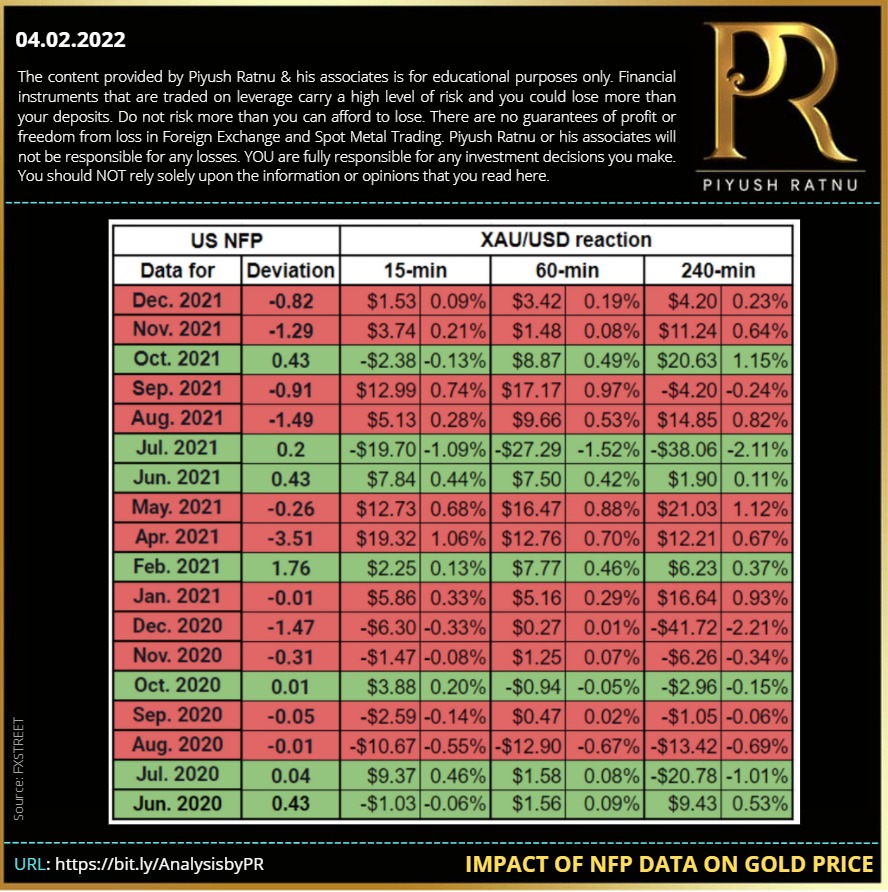

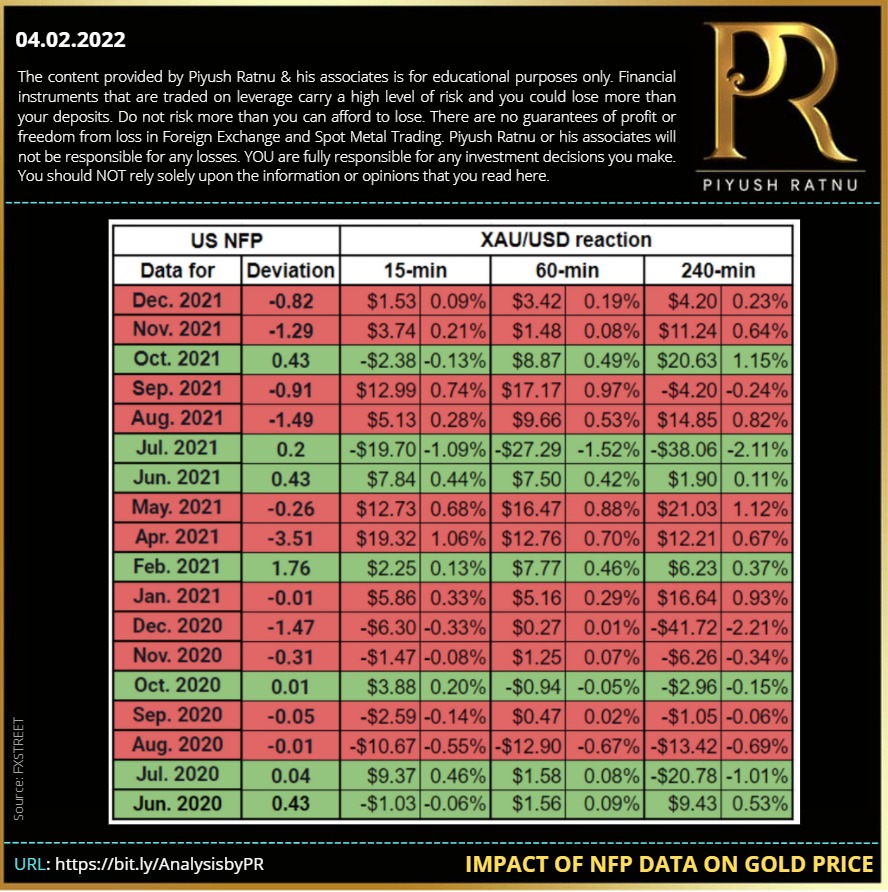

HOW IMPACTFUL HAS THE US JOBS REPORT BEEN ON GOLD’S VALUATION IN LAST FEW MONTHS?

There were 11 negative and seven positive NFP surprises in the previous 18 releases, excluding data for March 2021. On average, the deviation was -0.92 on disappointing prints and 0.47 on strong figures. 15 minutes after the release, gold moved up by $3.66 on average if the NFP reading fell short of market consensus. On the flip side, gold gained $0.03 on average on positive surprises. This finding suggests that investors’ immediate reaction is likely to be more significant to a disappointing print.

However, the correlation coefficients we calculated for the different time frames mentioned above don’t even come close to being significant. The strongest negative correlation is seen 15 minutes after the releases with the r standing at -0.4. One hour after the release, the correlation weakens with the r rising to -0.23 and there is virtually no correlation to speak of four hours after the release with the r approaching 0. Several factors could be coming into play to weaken gold’s correlation with NFP surprises like weakening volumes, London closing hours, profit booking, reversed positions and others out of many. How to trade GOLD | XAUUSD accurately on Non Farm Payrolls Day?

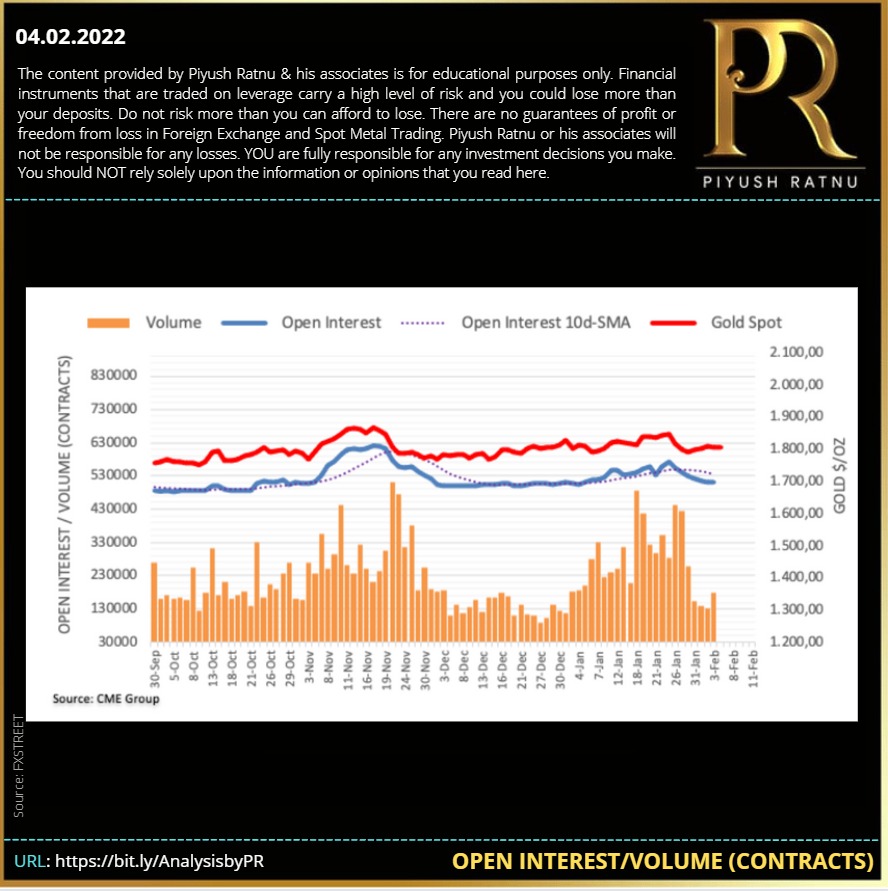

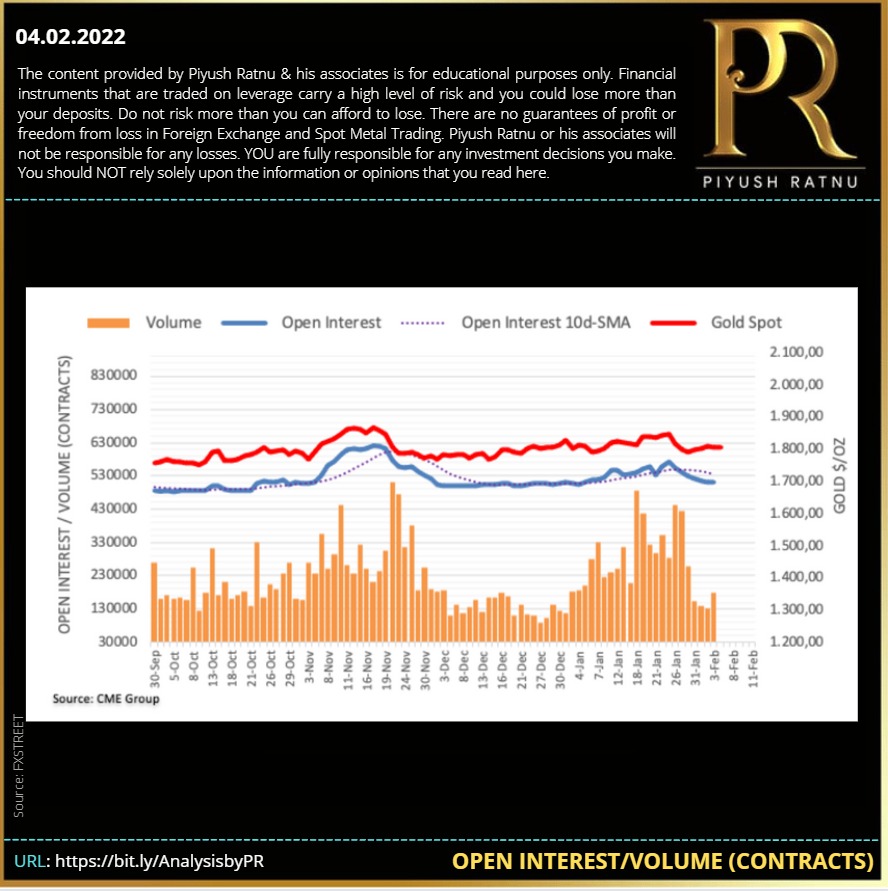

Open Interest/Volume (Contracts): Indicates following:

Considering advanced figures from CME Group for gold futures markets, open interest dropped for yet another session on Thursday, this time by around 2.3K contracts. Volume, instead, reversed the recent weakness and increased by nearly 50K contracts. Thursday’s small downtick in prices of gold was in tandem with shrinking open interest, ruling out a deeper pullback at least in the very near term. That said, the precious metal could now extend the consolidation around the $1,800 mark per ounce troy, while decent support emerges in the $1,777-1745 zone so far. How to trade GOLD | XAUUSD accurately on Non Farm Payrolls Day?

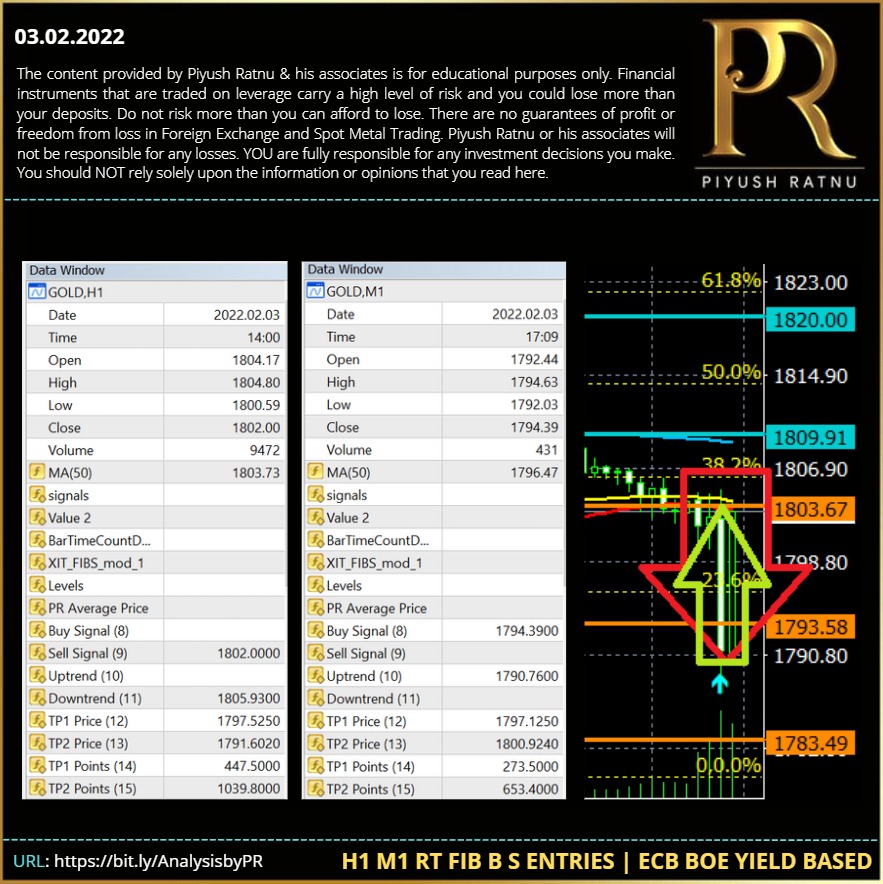

Gold Price – Key Indicators, Factors, Price Zones & SR Levels to watch:

IMPORTANT TECHNICAL LEVELS & READINGS

| SMA | |

| H1 SMA50 | 1804.25 |

| H1 EMA100 | 1804.43 |

| H1 EMA200 | 1808.65 |

| H4 SMA50 | 1810.00 |

| H4 EMA100 | 1812.00 |

| H4 EMA200 | 1810.82 |

| Daily SMA50 | 1802.88 |

| Daily EMA100 | 1802.94 |

| Daily EMA200 | 1793.60 |

| SR ZONES | |

| R1 | 1808.57 |

| R2 | 1821.16 |

| R3 | 1833.75 |

| R4 | 1841.52 |

| R5 | 1854.10 |

| S1 | 1800.80 |

| S2 | 1788.22 |

| S3 | 1775.64 |

| S4 | 1767.86 |

| S5 | 1755.55 |

DEATH CROSS Warning: The 50-SMA has cut the 200-SMA from above, which confirms a death cross – a bearish signal for gold traders as per SMA rule book. It will be worth observing the price movement today!

TECHNICAL SUMMARY How to trade GOLD | XAUUSD accurately on Non Farm Payrolls Day?

Kindly observe the crucial limits/stops levels mentioned by me in this analysis. Today, I prefer to BUY session/daily lows below Support zone, and I prefer to SELL above Resistance zones, if fundamentals support and favour the same.

It will be wise to place positions after 15 minutes of NFP Data / $15/25 movement, keeping in mind NYSE opening pressures might result in a reversal or extension of the price trend for next 30-45 minutes. Movement of 15,3 0, 45 or 60 dollars on Gold price is not something unexpected nowadays, and a surprise on Monday early trading hours can not be ruled out too, so closing all positions today in net average profit is always the best trading strategy for every trader who wants to safeguard his principle. How to trade GOLD | XAUUSD on Non Farm Payrolls Day?

The following might be UPTREND and DOWNTREND limits/stops (which remain same as mentioned in my analysis posted on 07 January, 2022) giving a huge opportunity to Fibonacci and SR zone based traders to make some quick profits after NFP Data is published:

BUY/SELL STOPS | BUY/SELL LIMITS: TARGET NAP ( Net Average Profit):

S5 ZONE 1755 | DOWN TREND (Below 1783) : 1777 – 1745 – 1717 – 1707 – 1685

R5 ZONE 1855 | UP TREND (After 1808) : 1818 – 1832 – 1850 – 1866 – 1888

It is always wise to PLAN THE TRADE, and then TRADE THE PLAN! Hence it is suggested to first observe the crash or rise with specific zones and levels in mind on the basis of various fundamental and technical parameters mentioned above, before entering a trade in a specific direction with a target of net average profit in a specific set of trades.

WARNING: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The author will not be held responsible for information that is found at the end of links posted on this page. The author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. The author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author is not a registered investment advisor and nothing in this article is intended to be investment advice. All performance information reflects past performance and is presented on a total return basis. Past performance is no guarantee of future results. Current performance may differ from the performance shown.

RISK WARNING | DISCLAIMER

Information on this Channel/Page contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Information or opinions provided by us should not be used for investment advice and do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. When making a decision about your investments, you should seek the advice of a professional financial adviser.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

The analysis and trading suggestions published by Piyush Ratnu does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Piyush Ratnu does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Piyush Ratnu shall not be responsible under any circumstances for the consequences of such activities. Piyush Ratnu and its affiliates, in no event, be liable to users or any third parties for any consequential damages or losses in any direct or indirect manner, however arising, including but not limited to damages caused by negligence or Force Majeure whether such damages were foreseen or unforeseen.

The capital value of units in the fund can fluctuate and the price of units can go down as well as up and is not guaranteed. You should not buy a warrant unless you are prepared to sustain a total loss of the money you have invested plus any commission or other transaction charges. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals. The high degree of leverage can work against you as well as for you hence implement risk management and money management strictly to safeguard your investment. Do not risk more than .10% of your principle amount in a single trade set.

Before deciding to invest in foreign exchange or other markets you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some, or all, of your initial investment. Therefore, you should not invest money that you cannot afford to lose. In some cases, it is possible to lose more than your initial investment as it is not always possible to exit a market at the price you intend upon doing so. There are also risks associated with utilizing an Internet-based trade execution software application including, but not limited to, the failure of hardware and software. You should be aware of all the risks associated with investing in foreign exchange, indices and commodities and seek advice from an independent financial advisor if you have any doubts.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu or his associates will not accept any liability for any loss or damage, including but without limitation to, any financial, emotional loss, which may arise directly or indirectly due to your decision. If you do not agree to the above terms, conditions and disclaimer YOU MUST leave this group with immediate effect and YOU MUST not act as per the information provided in this document.

-

Figure 7 Figure 4 CRASH and RISE STOPS | BS Entries -

Figure 6 MARKET PROFILE | TREND | SR | MTD | FRACTALS -

Piyush Ratnu GOLD XAUUSD Analysis | Forex Tutorials | Trading Courses -

Figure 4 DEATH CROSS -

Figure 3 Open Interest/Volume -

Figure 2 Impact of NFP Data on GOLD Rates -

Piyush Ratnu | XAUUSD ANALYSIS | Spot Gold | Non Farm Payrolls Day -

-

-

-

-

-

-