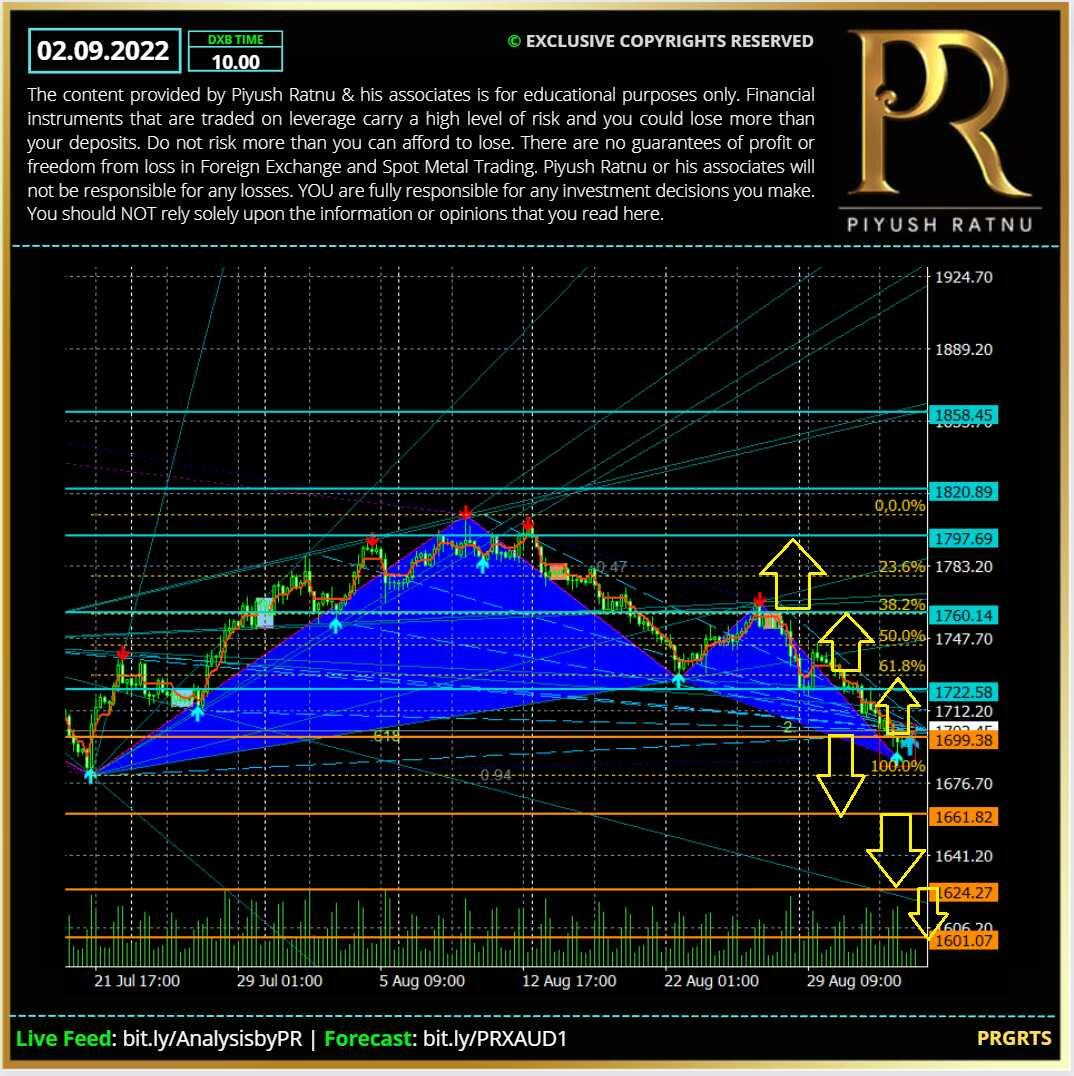

Analysis 02.09.2022 Accuracy Summary and Review:

Buying and Selling Spot Gold (XAUUSD) at the key price entry levels (+/-3/6/9) mentioned in my analysis dated 02.09.2022 with a target of net average profit in each set: in last 60 days gave accurate and positive results:

- S2/S3 ZONE 1666

- DOWN TREND (Below 1675): 1680/1666/1650/1636 | BUY LIMITS

- R2 ZONE 1717| UP TREND (Above 1711): 1717/1735/1755/1777 | SELL LIMITS

Accuracy Check:

September 2022:

September High: $1735 (12.09.2022)

September low: $1614 (28.09.2022)

October 2022:

October High: $1730 (12.09.2022)

October low: $1616 (21.10.2022) November low as on 04.11.2022: $1616

Read August NFP Day Analysis dated 02.09.2022 here.

I did not publish my analysis on NFP Data Day in October, 2022 as the numbers and scenarios looked same as mentioned in 02 September, 2022.

KEY FACTS responsible for THE KEY EVENTS observed since October, 2022

Reverse Repurchase Agreement Facility:

The Fed’s creation of a reverse repurchase agreement facility that’s accessible by foreign central banks means that international monetary authorities such as the Bank of Japan can keep a big chunk of their cash there earning interest instead of in Treasury bills and other securities. And when they need to do something with those dollars, they can just withdraw it from the Fed facility without ruffling markets. As with the domestic reverse repo facility, the so-called foreign RRP is a place where counterparties can stick their cash overnight with the US monetary authority. And that cash earns a rate that’s generally equivalent to the offering yield on the New York Fed’s domestic facility, making it a more than palatable alternative to a lot of market-based short-end instruments.

What is RRP?

An RRP is a liability on the Federal Reserve’s balance sheet, like reserves, currency in circulation and the Treasury’s General Account. When RRP transactions are settled, the New York Fed’s triparty agent transfers the cash proceeds received from RRP counterparties to the New York Fed.

As reported by Bloomberg on 23.09.2022: The risk of Japanese currency intervention spilling over and causing undue disturbances in an already under-fire US Treasury market is smaller than it once was thanks to tools that the Federal Reserve now has in place to make sure the market has enough dollars and places to park them. Foreign institutions currently have about $295 billion stashed there at the moment, according to Fed data for the period through Sept. 21, down from $301 billion a week earlier.

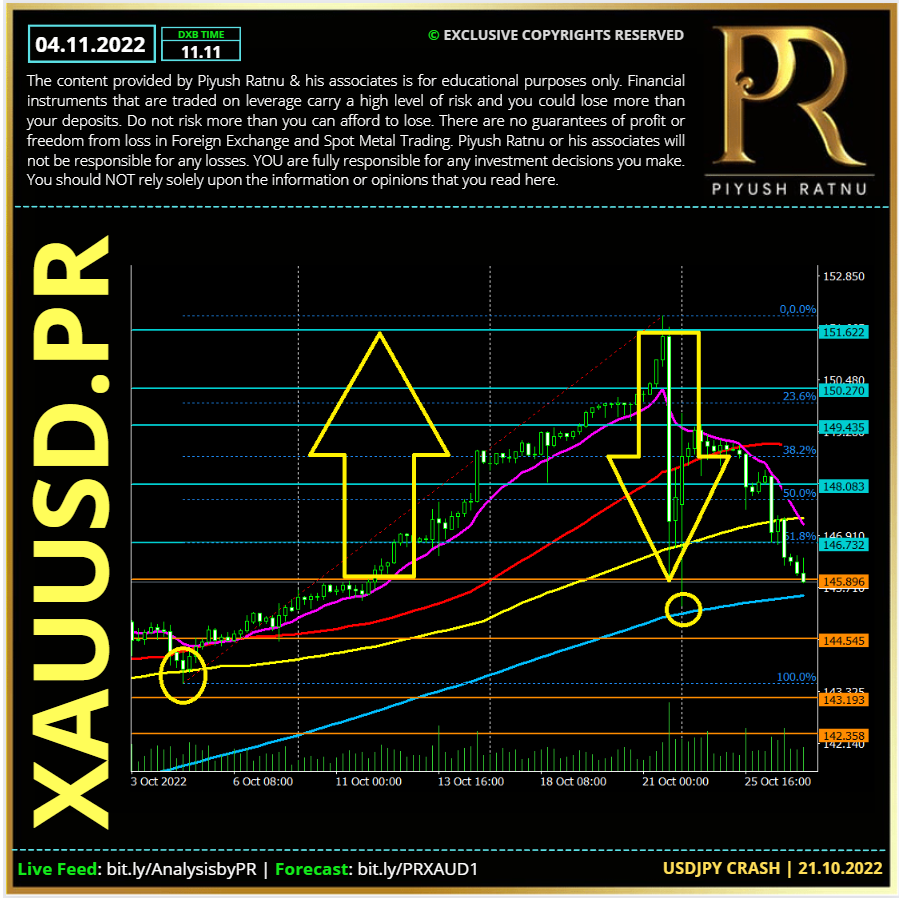

21.10.2022: The Bank of Japan dumped an estimated $30 billion worth of its U.S dollar reserves in a frantic attempt to protect the yen from yet more weakness. The move triggered a flash crash in the U.S dollar, while simultaneously igniting an explosive rally across multiple asset classes that trade inversely to the U.S currency including Precious Metals such as Gold and Silver. After the dollar rose to 151.94 yen, its highest since 1990, the intervention drove the greenback down more than 7 yen to a low of 144.50 yen. However, many publishers published the cause of flash crash of 7000 pips in USDJPY a crash due to FED members’ shrinking interest rate related statements, however later corrected the same by adding the real cause. The aggressive move by Japanese authorities wasn’t the first and definitely will not be the last.

This is the second time Japanese policymakers have stepped into the market since September to prop up the yen – which has lost almost 30% of its value against the dollar year-to-date because of the widening gap between U.S and Japanese monetary policy. The yen is the third-largest reserve currency in the world, behind the U.S dollar and the Euro – therefore has enormous potential to move the markets significantly. Japan isn’t the only country that has seen its currency plummet against the dollar this year.

25.10.2022:

China’s four largest state-owned banks stepped into prop up the yuan, which hit its weakest level since December 2007 – by dumping an undisclosed amount of their dollar reserves. China’s central bank has asked major state-owned banks to be prepared to sell dollars for the local unit in offshore markets as it steps up efforts to stem the yuan’s descent, four sources with knowledge of the matter said. State banks were told to ask their offshore branches, including those based in Hong Kong, New York and London, to review their holdings of the offshore yuan and ensure U.S. dollar reserves are ready to be deployed, three of the sources, who declined to be identified. (Source-Reuters). Once again, this intervention triggered another flash crash in the U.S dollar, while immediately sparking explosive rallies across multiple asset classes that trade inversely to the U.S currency including Gold. I had alerted repeatedly since 17.10.2022 regarding Liquidity Trap in action, with an estimated total price movement of up to $ 150-200 in the emerging market cycle and pattern in bonds, yields and stocks. The flash crash in USDJPY didn’t impact GOLD much, however an upward movement till 1670 was observed twice after the flash crash from the $1616/1636 zones, respectively. CMP $1647.

27.10.2022 ECB Interest Rate

The European Central Bank raised interest rates again on Thursday and signalled it was keen to start shrinking its bloated balance sheet, taking another big step in tightening policy to fight off a historic surge in inflation. Worried that rapid price growth is becoming entrenched, the ECB is raising borrowing costs at the fastest pace on record, with further hikes almost certain as unwinding a decade’s worth of stimulus will take it well into next year and beyond. In a series of complex moves, the central bank for the 19 countries that use the euro raised its deposit rate by 75 basis points to 1.5%, as expected, taking the total increase to 2 percentage points over three meetings. Until July, ECB rates had been in negative territory for eight years.

ECB interest rate

The Governing Council decided to raise the three key ECB interest rates by 75 basis points. Accordingly, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 2.00%, 2.25% and 1.50% respectively, with effect from 2 November 2022.

Asset purchase programme (APP) and pandemic emergency purchase programme (PEPP)

The Governing Council intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it started raising the key ECB interest rates and, in any case, for as long as necessary to maintain ample liquidity conditions and an appropriate monetary policy stance.

As concerns the PEPP, the Governing Council intends to reinvest the principal payments from maturing securities purchased under the programme until at least the end of 2024. In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

The Governing Council will continue applying flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to countering risks to the monetary policy transmission mechanism related to the pandemic.

TLTRO

The targeted longer-term refinancing operations (TLTROs) are Eurosystem operations that provide financing to credit institutions. By offering banks long-term funding at attractive conditions they preserve favourable borrowing conditions for banks and stimulate bank lending to the real economy.

The TLTROs, therefore, reinforce the ECB’s current accommodative monetary policy stance and strengthen the transmission of monetary policy by further incentivising bank lending to the real economy.

TLTRO III

The third TLTRO programme consists of a series of ten targeted longer-term refinancing operations, each with a maturity of three years, starting in September 2019 at a quarterly frequency. Borrowing rates in these operations can be as low as 50 basis points below the average interest rate on the deposit facility over the period from 24 June 2020 to 23 June 2022, and as low as the average interest rate on the deposit facility calculated over the life of the respective TLTRO III during the rest of the life of the same operation.

Gold demand firmer in Q3: Year-to-date gold demand resumes its pre-pandemic pace

(Source:WGC)

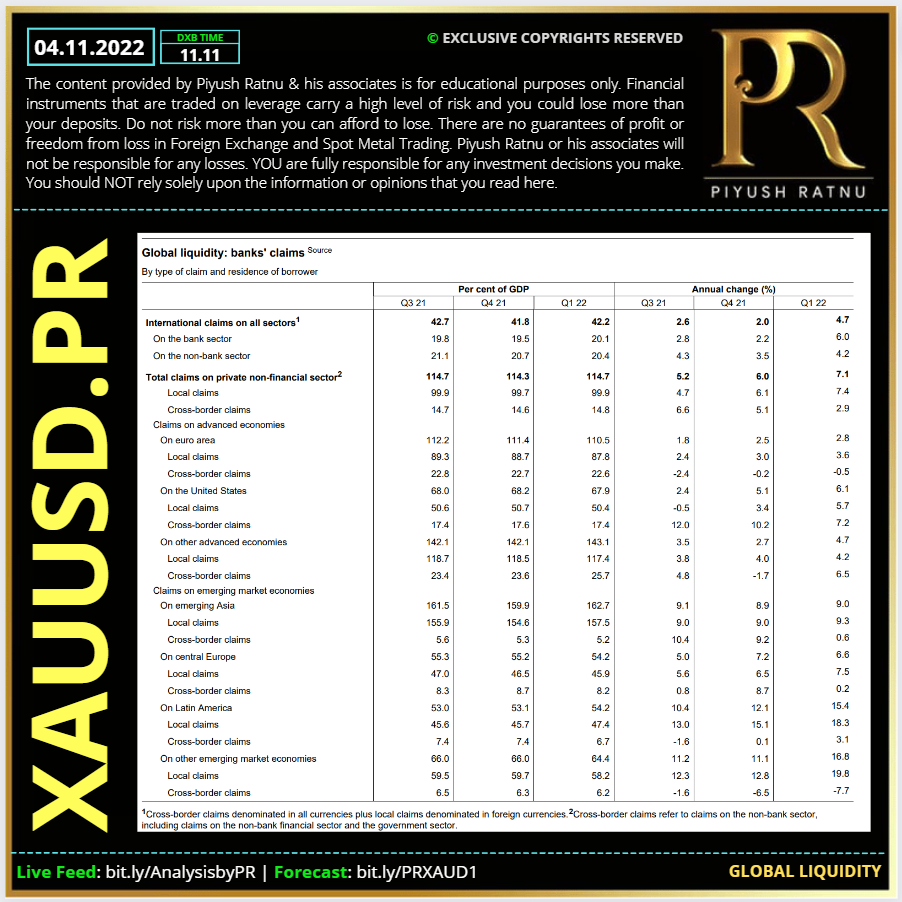

Healthy Q3, driven by stronger consumer and central bank buying, helped year-to-date demand recover to pre-COVID norms. Gold demand (excluding OTC) in Q3 was 28% higher y-o-y at 1,181t. Year-to-date (y-t-d) demand increased 18% vs the same period in 2021, returning to pre-pandemic levels.

Jewellery consumption reached a robust 523t, increasing 10% y-o-y despite the eteriorating global economic backdrop. Y-t-d demand is slightly firmer (+2%) at 1,454t. Investment demand (excluding OTC) for Q3 was 47% lower y-o-y at 124t, reflecting weak sentiment among some investor segments. 36% growth in bar and coin investment (to 351t) was insufficient to offset 227t of ETF outflows. OTC demand contracted significantly during the quarter, echoing weak investor sentiment in ETFs and futures markets. Central banks continued to accumulate gold, with purchases estimated at a quarterly record of nearly 400t. An 8% y-o-y fall in technology demand reflected a fall in consumer demand for electronics due to the global economic downturn.

Total gold supply increased marginally (+1% y-o-y) to 1,215t. A sixth consecutive quarter of y-o-y growth in mine production was partly offset by lower levels of recycling. Global central banks hold more than 35,500 metric tons (MT) of gold in their reserves. Most of that supply has been amassed since 2010, when central bankers commenced a gold-buying spree.

Central banks were net sellers of gold before that time, selling roughly 4,426 MT of gold between 2000 and 2009. But for more than a decade now they’ve been net buyers, and in 2022 central bank gold reserves are at their highest level since 1990, according to data provided by the World Gold Council (WGC).

Why do central banks purchase gold?

Central banks serve a few primary functions, including setting interest rates, regulating monetary policy and controlling the printing and circulation of coins and bills. However, their most important task is to provide price stability to their national currency while preventing banking system collapse. This is achieved through controlling inflation — although as the present global economic crisis has shown, sometimes the fate of a country’s currency may be difficult for a national bank to control.

Since central banks became net buyers of gold a decade ago, the metal’s price has increased 88 percent. In 2010, the price of an ounce of gold was US$1,096. At its 2020 peak, gold was selling for US$2,063.

After making the second largest net gold purchase (25 MT) by a central bank in Q1 2020, the Russian central bank suspended new gold purchases. Demand for gold from the Russian bank had been steady since 2006 prior to that point. At the time, weakening oil prices, rising bullion prices and the country’s already robust gold reserves were the likely reasons behind the buying moratorium. However, the higher gold price didn’t stop India and Turkey’s central banks from growing their gold holdings. In 2020, Turkey made the largest net purchase of gold, acquiring 198 MT, while India added more than 24 MT.

One of the primary reasons (Turkey and India) have been adding gold to their holdings is the weakness in their domestic currencies, which they seek to hedge by purchasing dollar denominated gold. Having added a net 19.4 metric tons (t) of gold to their reserves in April, central banks added a further 35t in May, with the same banks largely responsible for the main additions during both months—Turkey (13.3t), Uzbekistan (9t), Kazakhstan (6.3t) and India (3.8t). Qatar also added 4.7t of gold to its reserves in May to replenish all of the gold it had sold earlier in the year, the WGC noted, while Germany was the only major country to be a net seller in the month, shedding its gold reserves by 2t.

All this means that 2022 is shaping up to be a year for considerable gold acquisition by many countries worldwide, particularly emerging markets. (Source: WGC)

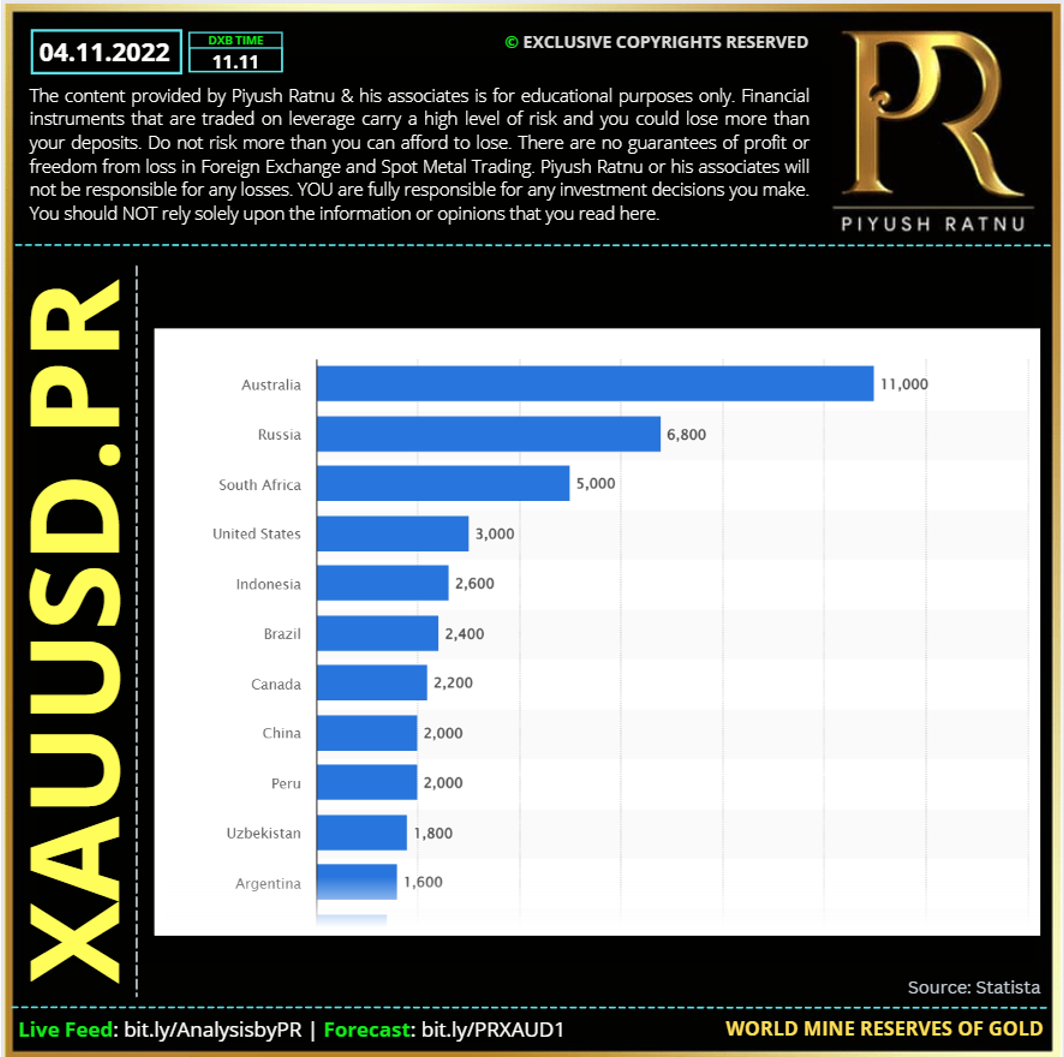

Which country has the most gold?

Australia holds the world’s largest gold reserves at 11,000 MT, followed by Russia at 6,800 MT. However, when it comes to central bank gold holdings, the US takes the top spot with 8,133.5 MT valued at US$528 billion. (Source: InvestingNews.com)

02.11.2022: FOMC: SUMMARY of FED MONETARY POLICY STATEMENT:

Important points from the policy:

(Source: https://www.federalreserve.gov/monetarypolicy/files/monetary20221102a1.pdf)

The Committee is strongly committed to returning inflation to its 2 percent objective.

In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in May.

Russia’s war against Ukraine is causing tremendous human and economic hardship. The war and related events are creating additional upward pressure on inflation and are weighing on global economic activity. The Committee is highly attentive to inflation risks.

IMPACT: more higher interest rates = pressure on GOLD

Movement on FOMC and Post FOMC. Both days our trading direction was correct. Sell direction on FOMC day and BUY direction post FOMC day.

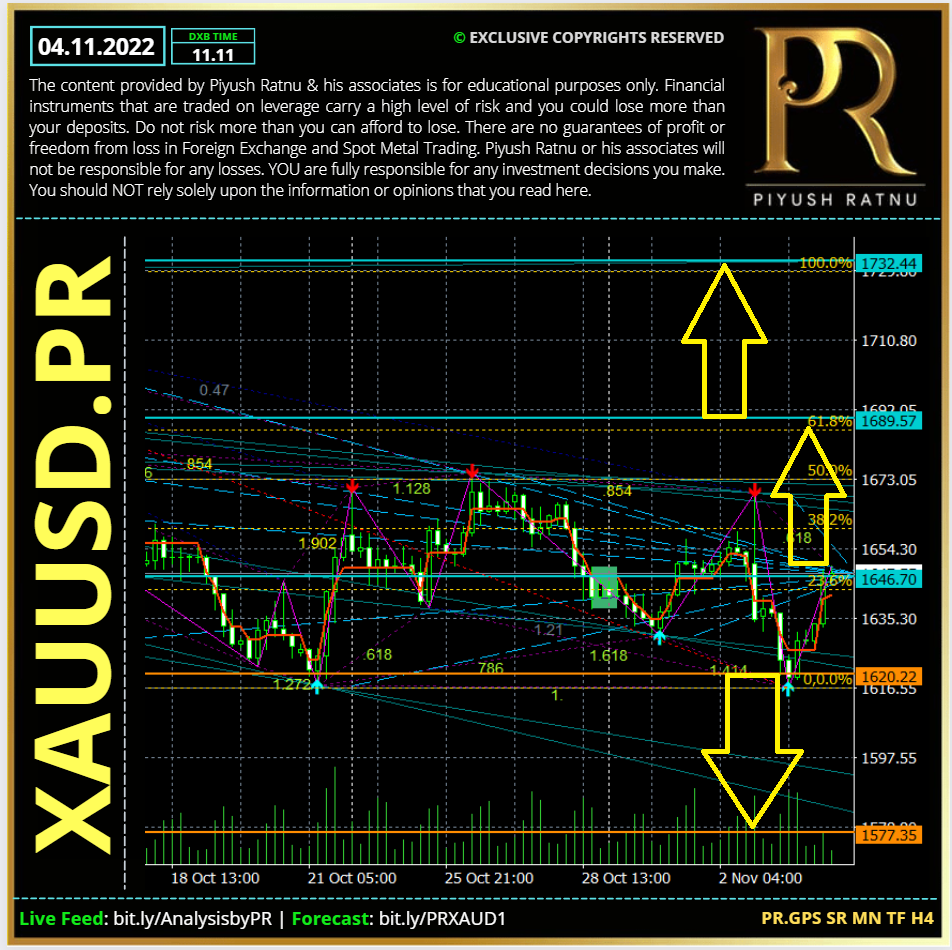

I has projected A pattern extension followed by V M1 M5 M15 23.6

A V Pattern base: H1 at XAUUSD price $1647.

Crash stops (BUY): 1626/1616 crucial stops

Rise Stops (SELL): 1669/1685 crucial stops

Movement traced: 1669-1636-1626-1616 RT 1616-1626-1636-1645(CMP 1647).

Ongoing Geo-Political Tensions which might impact XAUUSD price:

- North Korea Warns US

This week, North Korea threatened to unleash a powerful action if the US does not halt joint military drills with partners including South Korea, in what might be an effort by Kim Jong Un to lay the groundwork for his first nuclear test in five years.

“If the U.S. does not want any serious developments not suited to its security interests, it should stop the useless and ineffective war exercises at once,” said the statement from the Foreign Ministry, which was released by the official Korean Central News Agency. “If not, it will have to totally take the blame for all the consequences.”

Source: Bloomberg

- Saudi Arabia, US Share Intel on Possible Iran Attack

This week, Saudi Arabia and the US have shared information indicating Iran may attack the kingdom or other nations in the region sometime soon, leading Washington and Riyadh to adjust their military posture, according to people familiar with the matter.

The two countries as well as regional allies have raised their military alert level, said the people, who asked not to be identified discussing internal deliberations. They described the possible attacks as an effort to distract from nationwide protests that have roiled Iran in recent weeks.

Tensions remain high, with Iran arrayed against Saudi Arabia and other nations in the region after a series of attacks in recent years that included Iran’s Islamic Revolutionary Guard Corps firing more than 70 missiles in September into Iraq’s Kurdish region, where the US still has troops stationed. In addition, a United Nations-brokered truce between Yemen’s government backed by the Saudis and the Iran-backed Shiite Houthi rebel militia has expired.

Source: Bloomberg

- Russia – Ukraine Tension:

9 days back, as reported by BBC: Vladimir Putin has overseen annual exercises by Russia’s strategic nuclear forces at a time of heightened tensions with the West over his eight-month-long war in Ukraine. Ballistic and cruise missiles were launched from the Arctic to Russia’s Far East, the Kremlin said. The US was told about the drill under the terms of the New Start arms treaty. The launches took place as Russia makes unsubstantiated claims that Ukraine was plotting to use a “dirty bomb”. A “dirty bomb” is an explosive device mixed with radioactive material and the Russian allegations have been widely rejected by Western countries as false. Kyiv warned the claims indicate Moscow itself could be preparing such an attack. The last Russian nuclear drill took place five days before it invaded Ukraine. Ahead of the latest exercise, military officials in Washington pointed out that, in notifying the US, the Russians were complying with arms control obligations. Nato is also staging its own nuclear exercises, dubbed Steadfast Noon, in north-western Europe. Defence Minister Sergei Shoigu was seen on Russian TV saying that the aim of the drill was for military command and control to practise carrying out “a massive nuclear strike by the strategic nuclear forces in retaliation for the enemy’s nuclear strike”.

Source: BBC

Possible Impact on geo-political tensions related news/dispute related news/missile launch/nuclear test: XAUUSD price can shoot up in the following format: XAUUSD price in ($): 1666-1717-1777-1818-1866-1888-1926-1947-1966-2022-2070-2121 | CMP $1647

spot gold price forecast & analysis | XAUUSD: CMP $1647| 04.11.2022

Key Points:

- Spot Gold price broke below the $1666 threshold and fell to yearly low of $1,616 as the dollar extended its rally on Hawkish FOMC and improved risk tone.

- XAUUSD repeated the crash and rise scenarios: $1666 zone – $1636 – $1616 and reversed from $1616 to $1648 (today’s high at the time of writing)

- The US Federal Reserve (Fed) said on Wednesday, they see interest rates increasing until inflation is brought down, with the peak rate seen as higher than previously estimated.

- The policy announcements suggest that higher borrowing costs are likely to stay for longer, which could block any upside attempts in Spot Gold price.

- “SPDR Gold TrustGLD, the world’s largest gold-backed exchange-traded fund, said its holdings fell 0.82 percent to 911.59 tonnes on Thursday from 919.12 tonnes on Wednesday,” per Reuters.

This logically implies that investors’ sentiments around the XAUUSD price continues to remain less bullish and more bearish.

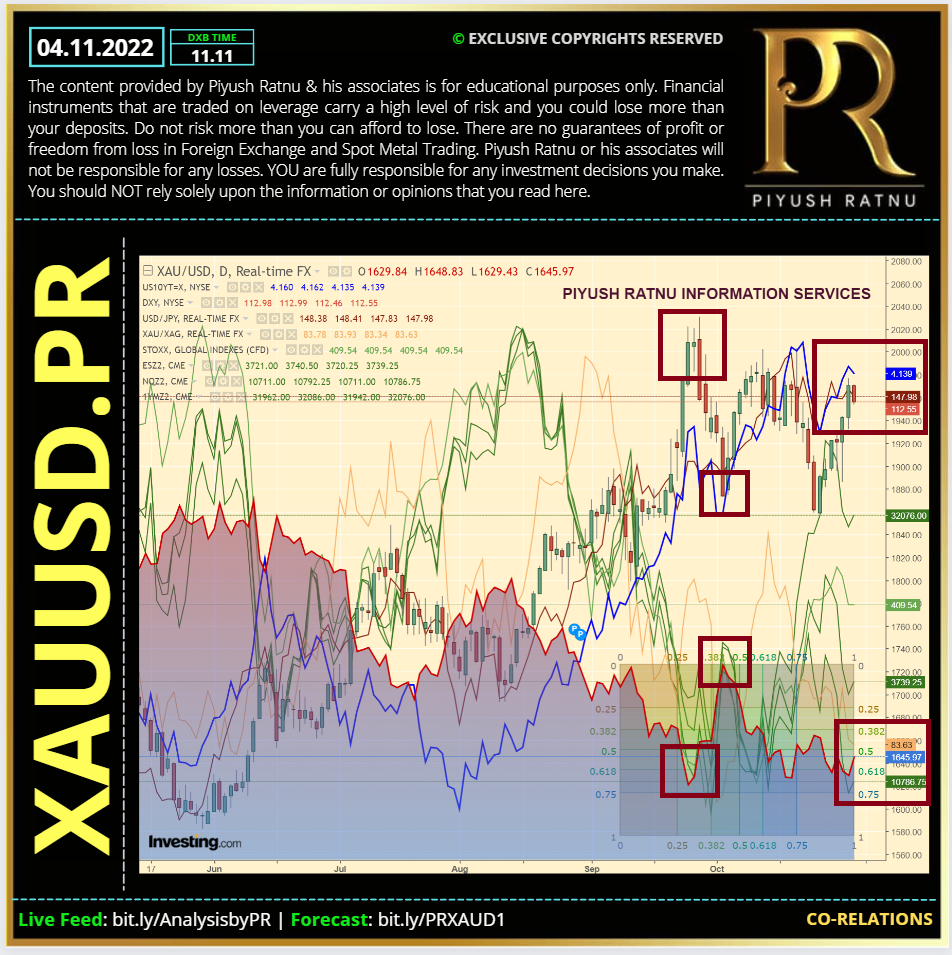

Figure 5: Reading Summary: XAUUSD | CMP $1647

Dollar Index is holding 112.300 zone, US 10YT at 4.139, XAUXAG ratio at 83.52 and USDJPY is holding 148.00 zone. Last time when DXY crossed 112.00 mark in September and October 2022: Gold price crashed till $1616 zone, and the same was observed yesterday too, Gold price crashed till $1616.00 before rising back to $1647 today morning.

How to trade Spot Gold XAUUSD on NFP data today?

XAUUSD Bearish Scenario: $1600/1575?

If the bearish momentum extends, gold price may fall further towards 1616/1600/1575 zone (after 1622) with 1616, 1600/1575/1555 as next stops, if Gold crash halts at 1600 zone a reversal can be expected with a RT 23.6 on M5 and M15 30% RT before/in next 9 trading days.

XAUUSD Bullish Scenario: $1717/1735, once again?

If the Bullish momentum pushes Gold price across $1685 barrier, $1717 and $1730 (1735 zone) can be the next target for Gold, opening way to $1777 zone.

Heading into the NFP show today, Spot Gold price is under a price trap of $1636 zone, as investors/traders are observing market closely after Hawkish statements by Mr. Powell, confusing FED monetary policy, rising Yields & strengthening Dollar. The US NFP will emerge as one of the main market driver for gold price and FED rate forecasts scheduled to be announced on 04 November, 2022. Point to be noted: let us not forget the geo-political tensions which can trigger an upward price rally of more than $150-240 in Spot Gold price.

Technical Analysis | XAUUSD CMP $1647

Gold Price – Key Indicators, Factors, Price Zones & SR (D1) (W1) Levels to watch:

| SMA | |

| H1 SMA50 | 1638 |

| H1 EMA100 | 1640 |

| H1 EMA200 | 1645 |

| H4 SMA50 | 1648 |

| H4 EMA100 | 1651 |

| H4 EMA200 | 1664 |

| Daily SMA50 | 1674 |

| Daily EMA100 | 1717 |

| Daily EMA200 | 1760 |

| SR ZONES D1 | |

| R1 | 1634 |

| R2 | 1649 |

| R3 | 1664 |

| R4 | 1673 |

| R5 | 1688 |

| S1 | 1624 |

| S2 | 1609 |

| S3 | 1594 |

| S4 | 1585 |

| S5 | 1570 |

| SR ZONES W1 | |

| R1 | 1651 |

| R2 | 1674 |

| R3 | 1696 |

| R4 | 1711 |

| R5 | 1733 |

| S1 | 1637 |

| S2 | 1614 |

| S3 | 1591 |

| S4 | 1577 |

| S5 | 1554 |

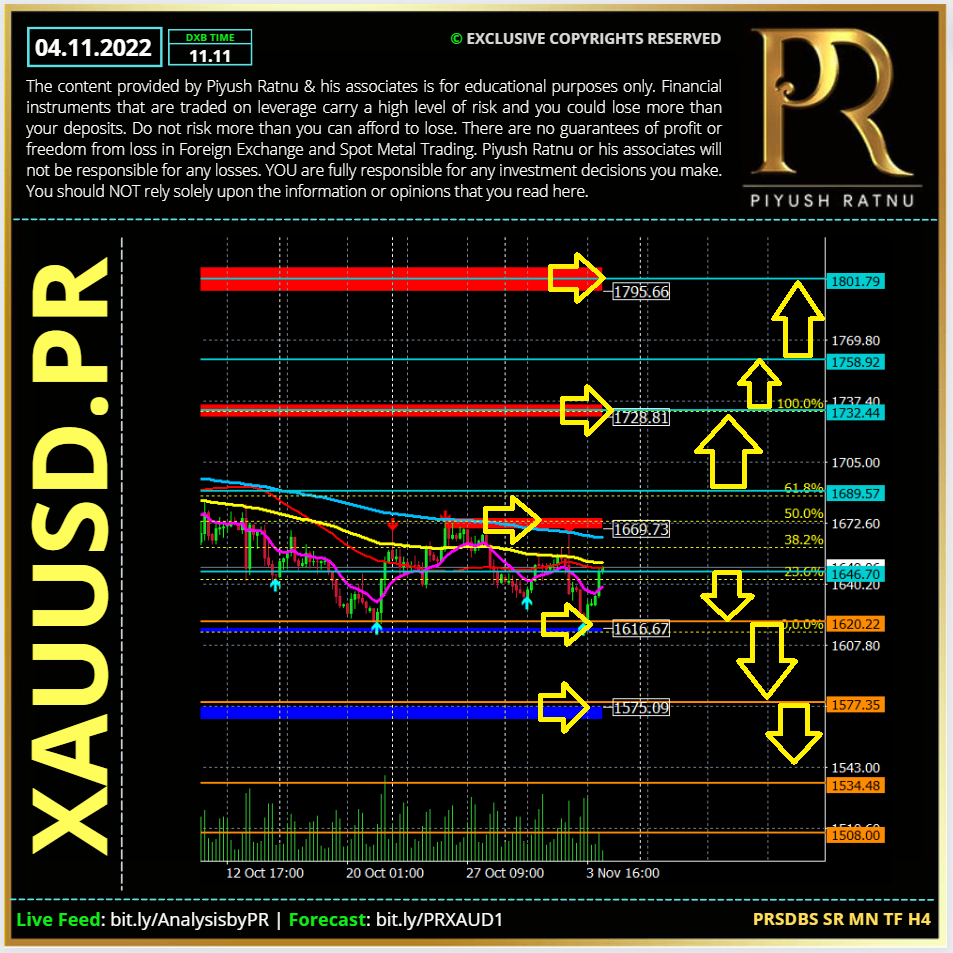

Figure 6: Reading Summary: XAUUSD | CMP $1647

A crash below $1622 might result in $1575, $1555 and $1535 price stops before crashing till $1508, retracement patterns might look like: (BUY) $1535, $1555, $1577 and $1620 (1616 zone).

A rise above $1690 might result in $1717, $1735 and $1777, retracement (SELL) $1777-1735-1717-1685.

PR.GPS SR MN TF H4 TRADING SCENARIOS | XAUUSD CMP $1647

TRADING SCENARIO:

- Observe price at US OPENING SS1 and then US SS2

- Observe S1/S2 zone and R4/R5 zone for reversals/retracement, Target NAP $3

- Do not enter between the pivot zone

- Observe: FIB 23.6% on M5 and M15 TF for NAP target price based exit in buy or sell entry after 30/60/90/120 minutes of NFP and $6/9/12/18 price movement sets

Long term: 9 (Short term)/18 (Long term) days for a A or V pattern formation - Movement of $50/100/150 dollars on Gold price is not something unexpected nowadays, and a surprise on Monday during early trading hours can not be ruled out too, so closing all positions today in net average profit is always the best trading strategy for every trader who wants to safeguard his principle.

I expect A/V pattern on H4 TF chart (from the rise/crash price at 16.30 hours today) in next 9 days (short term target) and 18 trading days (long term target). XAUUSD CMP $1647.

BUY/SELL STOPS | BUY/SELL LIMITS: TARGET $3 movement NAP (Net Average Profit):

S1/S2 ZONE 1616 | DOWN TREND (Below 1622) : 1616/1606/1575/1555 | BUY LIMITS

R4/R5 ZONE 1680| UP TREND (Above 1692) : 1707/1717/1735/1755 | SELL LIMITS

Terms: TF: Time Frame | RT: Retracement | SR: Support Resistance | NAP: Net Average Profit

It is always wise to first PLAN THE TRADE, and then TRADE THE PLAN!

Hence, it is suggested to first observe the crash or rise with specific zones and levels in mind on the basis of various fundamental and technical parameters mentioned above, before entering a trade in a specific direction with a target of net average profit in a specific set of trades.

WARNING: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The author will not be held responsible for information that is found at the end of links posted on this page. The author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. The author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author is not a registered investment advisor and nothing in this article is intended to be investment advice. All performance information reflects past performance and is presented on a total return basis. Past performance is no guarantee of future results. Current performance may differ from the performance shown.

RISK WARNING | DISCLAIMER

Information on this Channel/Page contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Information or opinions provided by us should not be used for investment advice and do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. When making a decision about your investments, you should seek the advice of a professional financial adviser.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

The analysis and trading suggestions published by Piyush Ratnu does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Piyush Ratnu does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Piyush Ratnu shall not be responsible under any circumstances for the consequences of such activities. Piyush Ratnu and its affiliates, in no event, be liable to users or any third parties for any consequential damages or losses in any direct or indirect manner, however arising, including but not limited to damages caused by negligence or Force Majeure whether such damages were foreseen or unforeseen.

The capital value of units in the fund can fluctuate and the price of units can go down as well as up and is not guaranteed. You should not buy a warrant unless you are prepared to sustain a total loss of the money you have invested plus any commission or other transaction charges. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals. The high degree of leverage can work against you as well as for you hence implement risk management and money management strictly to safeguard your investment. Do not risk more than .10% of your principle amount in a single trade set.

Before deciding to invest in foreign exchange or other markets you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some, or all, of your initial investment. Therefore, you should not invest money that you cannot afford to lose. In some cases, it is possible to lose more than your initial investment as it is not always possible to exit a market at the price you intend upon doing so. There are also risks associated with utilizing an Internet-based trade execution software application including, but not limited to, the failure of hardware and software. You should be aware of all the risks associated with investing in foreign exchange, indices and commodities and seek advice from an independent financial advisor if you have any doubts.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu or his associates will not accept any liability for any loss or damage, including but without limitation to, any financial, emotional loss, which may arise directly or indirectly due to your decision. If you do not agree to the above terms, conditions and disclaimer YOU MUST close this page and YOU MUST not act as per the information provided.