Accuracy Review of Analysis dated 03.02.2023:

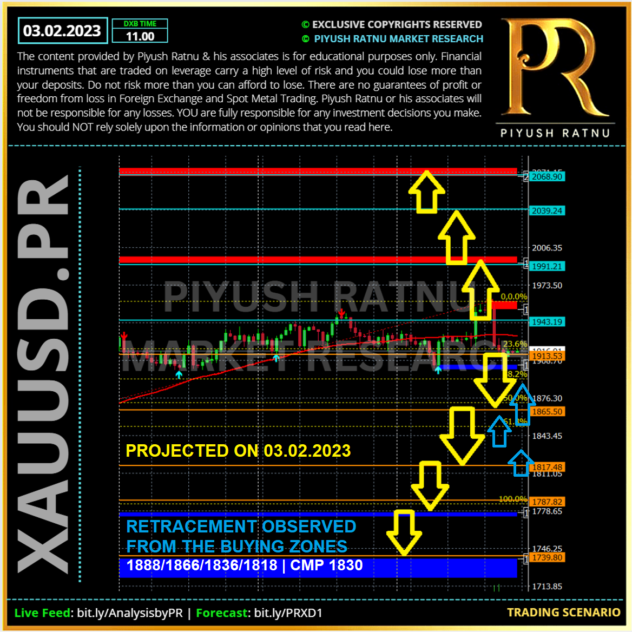

As projected in my analysis dated 03.02.2023:

If the bearish momentum extends, gold price may fall further towards $1836/1818 zone (after 1872) with 1866/1836/1818 as next stops, if Gold crash halts at 1836 or 1818 zone a reversal can be expected with a RT 23.6 on M5 and M15 30% RT before/in next 7 trading days.

BUY LIMITS PROJECTED:

S1/S2 ZONE 1888 | DOWN TREND (Below 1872) : 1866/1836/1818/1777 | BUY LIMITS

Figure 1: Piyush Ratnu XAUUSD Analysis | Projection in Analysis 03.02.2023

Figure 1: Piyush Ratnu XAUUSD Analysis | Projection in Analysis 03.02.2023

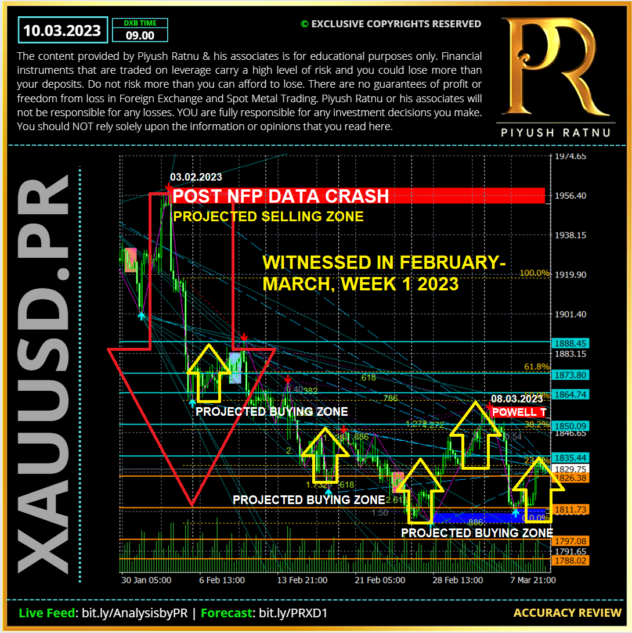

ANALYSIS ACCURACY REVIEW SUMMARY:

On + NFP Data, XAUUSD Spot GOLD crashed from $1966 zone (projected as SELLING ZONE) (1960 – 01.02.2023 high) to $1866 zone on 03.02.2023 post NFP data, retraced back to $1888 zone, followed by a crash till $1806 RT $1855, repeated crash till $1809 ($1818 zone) (post Powell statements on 08.03.2023) RT 1836 zone on 09.03.2023. Buying at the buying zones mentioned under Buy limits gave good returns to those who implemented the trading plan. CMP $1830.00

Figure 2: Piyush Ratnu XAUUSD Analysis | XAUUSD Price movement witnessed in February 2023

Figure 2: Piyush Ratnu XAUUSD Analysis | XAUUSD Price movement witnessed in February 2023

February high: $1960 (02.02.2023) | March low: $1809 (08.03.2023) | CMP$ 1830

Read NFP Day Analysis dated 03.02.2023 here: https://bit.ly/PRNFP03FEB2023

Key Fundamentals & EVENTS IMPACTING SPOT GOLD in march 2023:

- Xi’an, home to some 13 million people, will use lockdowns and school and business closures as part of a plan to contain influenza outbreaks, sparking concern among citizens about a return to the country’s economically-crippling Covid-19 restrictions.

- H3N2 influenza hits India: There has been a sudden outbreak of Influenza A subtype H3N2 cases across country which has sparked concerns. Hospitals across the country have been reporting thousands of Influenza A subtype H3N2 cases over the past few months.

- US-China Talks/Tensions:

- China criticised the LATEST Philippines agreement, saying: “US actions escalate regional tension and undermine regional peace and stability”.

- US sanctions 5 China-based suppliers to Iranian company selling drones to Russia

- The White House has said it will act against Chinese companies should they violate US sanctions or aid the Russian war effort

- Separately, 17 Hong Kong businesses are sanctioned for taking part in a ‘significant shadow banking’ system set up for Iranian firms

- Joe Biden’s budget aims at China with billions for Pacific islands: The proposed spending plan includes funding for the Marshall Islands, Micronesia and Palau, as Washington seeks to keep the 3 nations in the US orbit, US lawmakers have shown rare bipartisan unity on countering China

- Beijing warns against meeting between Tsai and US House speaker: Taiwan confirms Tsai Ing-wen to make US stopover, hits back at Beijing over McCarthy meeting warning. As Beijing voices ‘serious concern’, Chinese observers say military drills like those following Nancy Pelosi’s Taipei visit cannot be ruled out

- US lawmakers press intelligence chiefs on origins of coronavirus, threat from TikTok, Ex-CDC chief urges push to show what data intelligence community has, ‘where they got it, who their informants were and what their conclusions were’

- China likely on Nato agenda over ‘limitless’ Russia partnership, says Lithuanian foreign minister. China was identified as a “systemic challenge to Euro-Atlantic security” last year in Nato’s strategic concept – a key document that sets the alliance’s military and security strategy for the next 10 years. It was the first time that the country was identified by the alliance as a threat.

- Interest Rate Fears

Investors are digesting Jerome Powell’s signaling after the Federal Reserve chief told lawmakers no decision had been made on the pace of the next move. He reiterated however, that an acceleration in tightening was still on the table, and rates may go higher than anticipated should economic data warrant.

The comments coincided with another round of US jobs figures that came in on the hot side, bolstering bets that policymakers will remain hawkish. Wagers now solidly tilt toward a half-point move in March, rather than the quarter-point earlier expected.

President Joe Biden is proposing a series of new tax increases on billionaires, rich investors and corporations in his latest proposal for how Congress should prioritize taxes and spending. Biden’s budget request to Congress, which is slated to be released Thursday, calls for a 25% minimum tax on billionaires, according to a White House official familiar with the proposal who declined to be named because the plan is not yet public. The plan would also nearly double the capital gains tax rate for investment to 39.6% from 20% and raise income levies on corporations and wealthy Americans.

- The US Dollar Index(DXY) continues rising above 105.000 (CMP 105.220) from strong support zone: 100.500 after 10-year US Treasury yields witnessed immense pressure and crashed down to near 3.35% followed by a reversal to 3.90%.

- YEN: USD/JPY continues rising from strong support zone: 128.500, currently trading at 136.600, after reversing from the high at 137.900 (08.03.2023, XAUUSD $1809). The BoJ keeps the short-term interest rate target at -0.1% while directing 10-year Japanese Government Bond (JGB) yields within the band of +/-0.50%. While talking about the sentiment, BoJ highlights inflation fears and joins the New York Fed to challenge the policy doves, suggesting more rate hikes and question the economic growth, which in turn creates more down pressure on Spot Gold price.

- Risk-Off Mood: The latest risk-off mood and cautious sentiment ahead of the Nonfarm Payrolls (NFP) join the geopolitical fears to weigh on sentiment. Among them, US President Joe Biden’s budget proposal for 2024 and the US partnership with the UK and Australia for nuclear submarines weigh on the risk appetite and the XAU/USD.

- US NFP: Gold price (XAU/USD) remains pressured around the $1,832 market as markets brace for the US jobs report, after witnessing a haywire move on the Bank of Japan’s inaction, during early Friday. It is worth noting that the precious metal’s latest weakness appears more linked to the risk-off mood than to the US Treasury bond yield and the US Dollar as both these catalysts are in the red zone, despite of a rise recently. The US jobs report for February will be observed closely as traders have recently faced the market’s bets on the 50 bps rate hike in March.

Economists are expecting the United States economy to add 205K jobs in February when compared to the stunner 517K job gains seen in January. The Average Hourly Earnings are seen higher at 4.7% YoY in February vs. 4.4% previous. The US Unemployment Rate is likely to hold steady at 3.4% in the reported month. Point to be noted: Disappointing US Jobless Claims might help Gold price rebound, as a surprise.

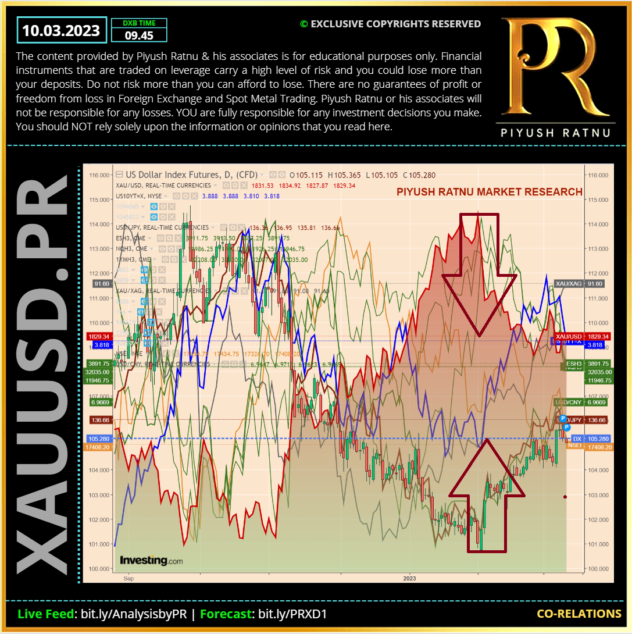

Figure 3: Reading Summary: XAUUSD co-relations | CMP $1830

A RISE in Dollar Index was observed from 100.500 zone (02.02.2023) till 105.300 zone in last 25 days, US10YT crashed from 3.910 zone till 3.600 zone. USDJPY is rising after hitting the 128.500 mark on 02.02.2023 currently trading at 136.500 zone. As per past data, co-relations and math: I had alerted in my analysis that if USDJPY crosses 136.600 mark, XAUUSD might hit $1818 mark, and the same was observed in last 6 trading days.

In current scenario, and as per past data fundamentals-based co-relations have guided us in a more accurate manner than technical co-relations, however I prefer to compare and match both for a better accuracy.

How to trade Spot Gold XAUUSD on NFP data today?

XAUUSD Bearish Scenario: $1818/1777/1735/1717?

If the bearish momentum extends, gold price may fall further towards $1800/1777 zone (below 1803) with 1790/1777/1735/1717 as next stops, if Gold crash halts at 1777 or 1735 zone a reversal can be expected with a RT 23.6 on M5 and M15 30% RT before/in next 9 trading days.

XAUUSD Bullish Scenario: $1888/1907/1926/1947?

If the Bullish momentum pushes Gold price across $1872 barrier, $1888 followed by $1907, $1926 zone can be the next target for Gold, opening way to $1947-1966 zone as an ideal sell entry.

Heading into the NFP show today, Spot Gold price is under a price trap of $1836 zone, as investors/traders are observing market closely after interest rate and monetary policy related statements by Mr. Powell on 08 March, 2023.

The US NFP will emerge as one of the main market driver for Gold price. Point to be noted: let us not forget ongoing geo-political tensions between Russian – Ukraine and China – Taiwan_US which can trigger an upward price rally of more than $100/150 in Spot Gold price.

Technical Analysis | XAUUSD CMP $1830 | Gold Price – SR (D1) (MN) Levels to watch:

| SR ZONES MN | |

| R1 | 1845 |

| R2 | 1904 |

| R3 | 1936 |

| R4 | 2000 |

| R5 | 2059 |

| S1 | 1808 |

| S2 | 1749 |

| S3 | 1690 |

| S4 | 1653 |

| S5 | 1594 |

| SR ZONES D1 | |

| R1 | 1835 |

| R2 | 1850 |

| R3 | 1864 |

| R4 | 1873 |

| R5 | 1888 |

| S1 | 1826 |

| S2 | 1811 |

| S3 | 1797 |

| S4 | 1788 |

| S5 | 1773 |

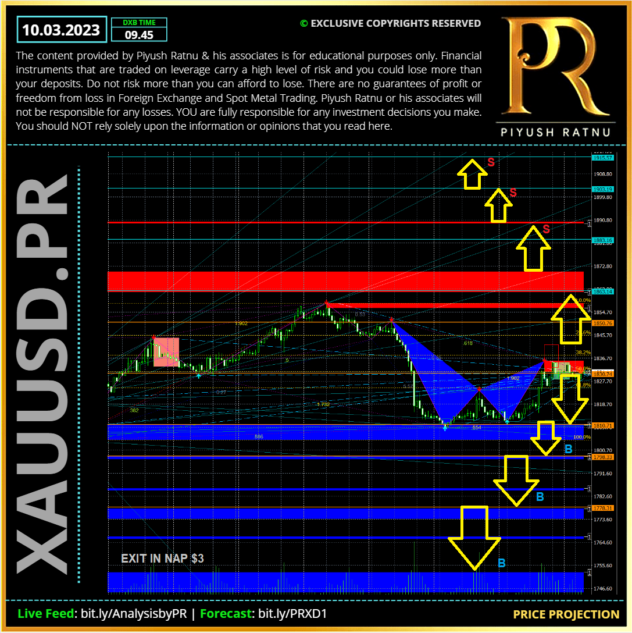

XAUUSD: Spot Gold Price Projection and Trading Scenario | XAUUSD CMP $1830

Figure 4: Trading Scenarios: SR-W1 PR MTD FIB RT TF H1

Figure 4: Trading Scenarios: SR-W1 PR MTD FIB RT TF H1

PROJECTED TRADING SCENARIO:

- Observe price at US OPENING D1 SS1 and then US SS2

- Observe W1.SR: S4/S5 zone and R1/R2 zone for reversals/retracement, Exit NAP $3

- Do not enter between the pivot zone

- ObserveD1SR: FIB 23.6% on M5 and M15 TF for NAP target price based exit in buy or sell entry after 30/60/90/120 minutes of NFP and $15/25 price movement sets

Long term: 9 (Short term)/18 (Long term) days for an A or V pattern formation - Movement of $90/120 dollars on Gold price is not something unexpected nowadays, and a surprise on Monday during early trading hours cannot be ruled out too, so closing all positions today in net average profit is always the best trading strategy for every trader who wants to safeguard his principal.

I expect V pattern on H1 and H4 TF chart in next 9 days (short term target) and 12 trading days (long term target). XAUUSD CMP $1830.

BUY/SELL STOPS | B/S LIMITS: TARGET Net 23.6 RT M15/30/H1 or NAP $3:

S4/S5 ZONE 1777 | DOWN TREND (Below 1803) : 1790/1777/1735/1717 | BUY LIMITS

R1/R2 ZONE 1966| UP TREND (Above 1872) : 1888/1907/1926/1947 | SELL LIMITS

Terms: TF: Time Frame | RT: Retracement | SR: Support Resistance | NAP: Net Average Profit

It is always wise to first PLAN THE TRADE, and then TRADE THE PLAN!

Hence, it is suggested to first observe the crash or rise with specific zones and levels in mind on the basis of various fundamental and technical parameters mentioned above, before entering a trade in a specific direction with a target of net average profit in a specific set of trades.

WARNING: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The author will not be held responsible for information that is found at the end of links posted on this page. The author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. The author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author is not a registered investment advisor and nothing in this article is intended to be investment advice. All performance information reflects past performance and is presented on a total return basis. Past performance is no guarantee of future results. Current performance may differ from the performance shown.

RISK WARNING | DISCLAIMER

Information on this Channel/Page contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Information or opinions provided by us should not be used for investment advice and do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. When making a decision about your investments, you should seek the advice of a professional financial adviser.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

The analysis and trading suggestions published by Piyush Ratnu does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Piyush Ratnu does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Piyush Ratnu shall not be responsible under any circumstances for the consequences of such activities. Piyush Ratnu and its affiliates, in no event, be liable to users or any third parties for any consequential damages or losses in any direct or indirect manner, however arising, including but not limited to damages caused by negligence or Force Majeure whether such damages were foreseen or unforeseen.

The capital value of units in the fund can fluctuate and the price of units can go down as well as up and is not guaranteed. You should not buy a warrant unless you are prepared to sustain a total loss of the money you have invested plus any commission or other transaction charges. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals. The high degree of leverage can work against you as well as for you hence implement risk management and money management strictly to safeguard your investment. Do not risk more than .10% of your principle amount in a single trade set.

Before deciding to invest in foreign exchange or other markets you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some, or all, of your initial investment. Therefore, you should not invest money that you cannot afford to lose. In some cases, it is possible to lose more than your initial investment as it is not always possible to exit a market at the price you intend upon doing so. There are also risks associated with utilizing an Internet-based trade execution software application including, but not limited to, the failure of hardware and software. You should be aware of all the risks associated with investing in foreign exchange, indices and commodities and seek advice from an independent financial advisor if you have any doubts.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu or his associates will not accept any liability for any loss or damage, including but without limitation to, any financial, emotional loss, which may arise directly or indirectly due to your decision. If you do not agree to the above terms, conditions and disclaimer YOU MUST close this page and YOU MUST not act as per the information provided.