How to trade NFP (Non Farm Pay Roll Data) with 100% Net Profit Accuracy?

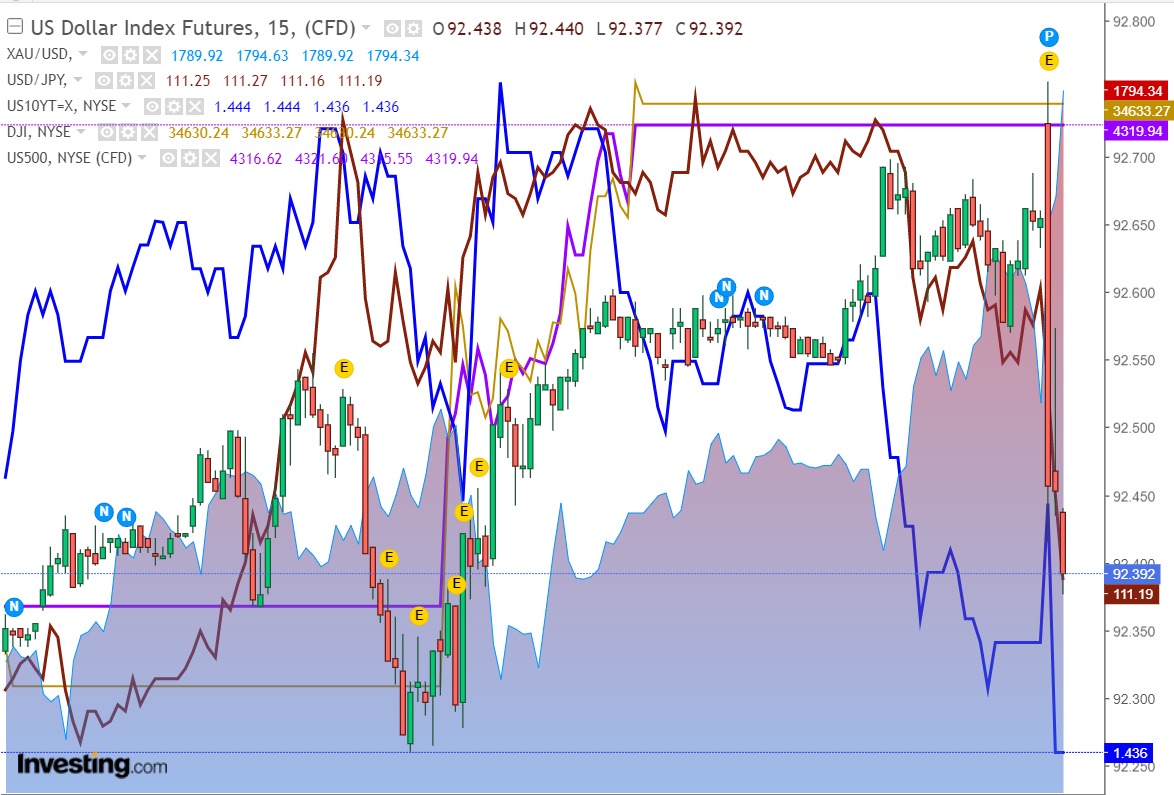

Analysis: Date: 02 July,2021 15.00 hours

• Gold heads towards $1800 as markets remain cautiously optimistic.

• Gold awaits NFP to confirm the bullish reversal despite Fed’s hawkish turn.

• Gold price is advancing for the third straight day on the final trading day of this week, with all eyes on the much-awaited US NFP data release to confirm the bullish reversal from two-month troughs of $1751. The recovery in gold price is gaining traction despite the persistent strength in the US dollar against its main peers.

• The US Treasury yields are on a losing spree, which has fuelled gold’s advance. Delta covid strain flareups have raised concerns over its impact on the global economic recovery, boosting gold at the expense of the risk-sensitive assets.

• Gold’s fate now hinges on the US NFP data, which is likely to throw fresh hints on the Fed’s next policy move. However, if the data disappoints just like the last time, gold price is likely to recapture $1800 while the dollar reverses recent gains.

• Despite the fact that the FOMC dot plot shifted hike expectations forward to late-2023 (median showing a 50bp of tightening), with many traders expecting a much earlier tightening, and that Chair Powell has started the process of preparing markets for QE tapering, we believe that the yellow metal is still in a position which makes a return to a $1,900/oz range possible into 2022.

• So far treasury markets don’t seem to be worried about out of control price increases. Even if there is a period of above expectation prices, we suspect that Mr. Powell and friends would intervene in the Treasury market should yields rise to the point that they would erode financial conditions and threaten the Fed’s ability to deliver on its full employment mandate. This all likely means real rates remain at the lows, along the longer end of the curve too, which is gold accretive.

• Ahead of the critical data release, gold price could maintain its range play below the $1800 mark, as investors refrain from placing any big directional bets on the precious metal.

• A data disappointment could possibly pour cold water on the Fed’s tapering and tightening expectations, in turn, offering extra zest to gold bulls.

• Nonfarm Payrolls in US is expected to rise by 690,000*RJB/720,000*BB in June.

• There is a strong correlation between surprising NFP prints and major pairs’ immediate movements.

• Investors are likely to react to a disappointing NFP more strongly than a positive reading.

Important Numbers

R: 1808/1818

S: 1762/1752

SiA H1 1772 S S1762

SiA M30 1777-1770-1762-1755

At Resistance we sell | At Support we BUY. We always react on the market movement, we do not believe in predicting markets.

STOCKS are set to OPEN HIGHER, resulting in Gold price reversal if GOLD prices rises. However if Gold price crashes on NFP, Gold price may crash more 10-15$ after NFP movement of $15-20 resulting in total $40 movement downwards at 16.30 hours DXB.

SELL HIGHS

SELL SESSION and DAILY HIGHS

Entering in BUY Direction at the time of news can result in a trap.

Strategy:

US SS1 and then US SS2

Observe S2-S3 R3-R4 for reversals/retracement

Observe: FIB 61.8% followed by S2

Observe FIB 38.2 followed by R3 and R4

Implement RM till 25 after 12/15

Implement SR after 25

GR not to be used. till 20 if SR needs to be ignored.

SCK 30 1 4 | OBO

Point to be noted: Bloomberg is showing different numbers (720k as expected NOT as actual) and Investing.com is showing different EXPECTED Number (690,000), that doesn’t mean NFP will be positive.

Kindly do not get confused with higher different numbers displayed on Bloomberg as compared to Investing.com

Connect with us for more details and detailed analysis regarding Bullion Trading and Forex Trading.