After AUGUST,

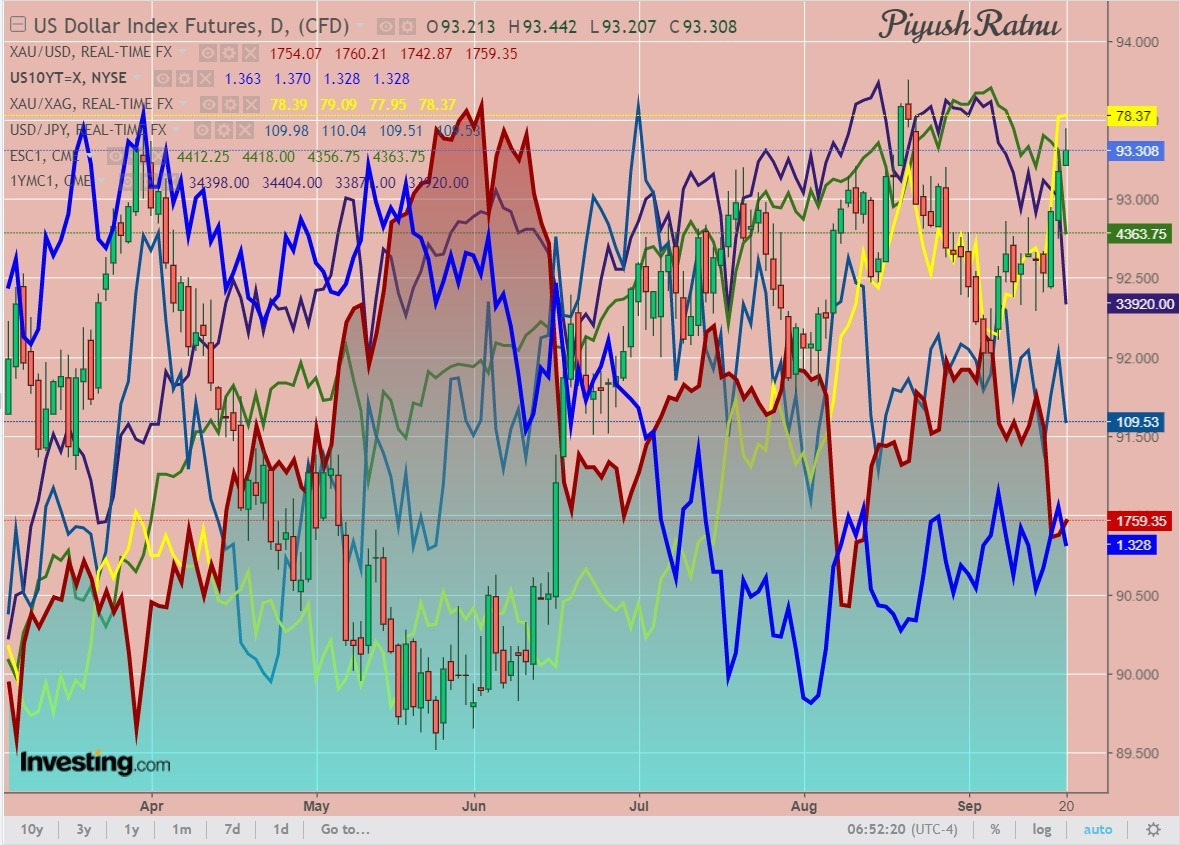

September is the cruelest month, and it’s playing out that way once again, with rolling corrections all over the place, something that is, again, typically a precursor to the seasonal decline that begins in just a couple of days.

STAY ALERT.

The Federal Reserve is likely to announce its tapering plans, starting by the end of this year, at its September 21-22 monetary policy meeting. The Bank of England may also hint at tapering, given the rising inflation in the UK. A potential withdrawal in the monetary policy stimulus will continue to bode ill for gold. A failure to defend the monthly lows of $1742, a fresh leg down could initiate towards the $1700 psychological magnate. Alternatively, the pattern support now resistance at $1753 could challenge gold’s road to recovery.

After Thursday’s $50 slide, gold price looked to stabilize on Friday, although held on to multi-week lows near $1750. Sellers took a breather after the previous decline, which was mainly seen as a chart-based sell-off after gold price failed to resist above the $1800 barrier. The slide also ensued after the US Retail Sales surprised to the upside in August, showing signs of strengthening economy and reinforced Fed’s tapering bets. On Friday, gold price attempted a bounce but lacked conviction amid a broadly firmer US dollar. The troubled Chinese property developer giant Evergrande’s potential default story dented the investors’ sentiment and lifted the dollar’s safe-haven appeal while rising Treasury yields on tapering bets also aided the greenback, limiting gold’s upside attempts.

Heading into a big week, with the Bank of England and the Fed central bank meetings in focus, gold price resumes last week’s downtrend and refreshes monthly lows near $1740 amid Fed’s tapering speculations and as risks surrounding Evergrande build up. The US dollar index holds at monthly tops, as the Fed is likely to announce its tapering plans, starting by the end of this year, at its September 21-22 monetary policy meeting. The BOE may also hint at tapering, given the rising inflation in the UK. A potential withdrawal in the monetary policy stimulus will continue to bode ill for gold price. Later in the day, the dynamics in the US dollar and the broader market sentiment will continue to have a significant bearing on gold trades, as the economic calendar appears scarce.

As observed on the four-hour chart, gold price has confirmed a bear pennant pattern, considering the recent consolidation that followed the previous week’s slide. Gold price closed the four-hourly candlestick below the rising trendline support at $1752, charting out the bearish continuation formation. The death cross validated on the same time frame on Friday, adds credence to the potential downside. The Relative Strength Index (RSI) is holding in the oversold territory, suggesting a bounce could be in the offing. However, given the bearish technical setup, any recovery attempt could be seen as a good selling opportunity. A failure to defend the monthly lows of $1742, a fresh leg down could initiate towards the $1700 psychological magnate. Alternatively, the pattern support now resistance at $1753 could challenge gold’s road to recovery.

Further up, the pattern resistance at $1759 could be the next relevant upside target. A sustained move above the latter could expose the bearish 21-Simple Moving Average (SMA) at $1771 (1777 zone).

All in all, the path of least resistance for the gold price appears to the downside.

The question remains the same:

CRASHING GOLD: A Buying Opportunity or One should wait till this Year’s NEW low?

So much money printed. Excessive debt. Even pandemic! And gold failed to hold gains. But that’s how markets work, no matter what gold permabulls say. Lots of money has been already printed, and the world has been suffering from the pandemic for well over a year. Gold should be soaring in this environment! Silver should be soaring! Gold stocks should be soaring too!

This is what happened in the previous 3 cases after the retail sales report:

• gold declined after retail sales disappointed in June

• gold topped after retail sales outperformed in July

• gold paused its rally after retail sales disappointed in August

• gold declined after retail sales outperformed in September

Gold failed to hold its gains above its 2011 highs. Can you imagine that? So much money printed. Excessive debts. Even pandemic! And gold still failed to hold gains above its 2011 highs. If this doesn’t make you question the validity of the bullish narrative in the medium term in the precious metals sector, consider this:

Silver – with an even better fundamental situation than gold – wasn’t even close to its 2011 highs (~50). The closest it got to this level was a brief rally above $30. And now, after even more money was printed, silver is in its low 20s.

And gold stocks? Gold stocks are not above their 2011 highs, they were not even close. They were not above their 2008 highs either. In fact, the HUI Index – the flagship proxy for gold stocks – is trading below its 2003 high! And that’s in nominal prices. In real prices, it’s even lower. Just imagine how weak the precious metals sector is if the part of the sector that is supposed to rally first (that’s what we usually see at the beginning of major rallies) is underperforming in such a ridiculous manner. And that’s just the beginning of the decline in the mining stocks.

More to Come!

Evergrande collapse could have a ‘domino effect’ on China’s property sector

A spillover of the crisis at China Evergrande Group into other parts of the economy could become a systemic problem, a sizable number of developers in the offshore dollar market appear to be “highly distressed” and may not survive much longer if the refinancing channel remains shut for a prolonged period.

China’s “highly distressed” real estate companies are at risk of collapse as the country’s highly indebted developer Evergrande is on the brink of default. Evergrande, the world’s most indebted property developer, is crumbling under the weight of more than $300 billion of debt and warned more than once it could default. Banks have reportedly declined to extend new loans to buyers of uncompleted Evergrande residential projects, while ratings agencies have repeatedly downgraded the firm, citing its liquidity crunch.

The financial position of the other Chinese property developers also took a hit following rules outlined by the Chinese government to rein in borrowing costs of the real estate firms. The measures included placing a cap on debt in relation to a company’s cash flows, assets and capital levels.

Evergrande bosses face ‘severe punishment’ after securing early redemptions

Six senior Evergrande executives face “severe punishment” for securing early redemptions on investment products that the indebted Chinese property group subsequently told retail investors it could not repay on time, the company has said.

The admission comes ahead of a critical fortnight for the developer, which is struggling to repay investors, banks and bondholders, as well as complete flats for homebuyers who paid for their new properties in advance.

Hong Kong-listed shares in Evergrande fell as much as 18.9 per cent on Monday, while broader concerns about the health of China’s real estate sector triggered a wider sell-off.

Last week hundreds of retail investors protested at Evergrande’s headquarters in the southern city of Shenzhen, after executives said they needed more time to pay the interest and principal on high-yielding wealth management products issued by the group. They were joined by suppliers who said they had also not been paid. Du Liang, a senior company executive, told investors that Evergrande had used at least Rmb40bn ($6.2bn) from wealth management sales to fund construction projects across the country, according to people who participated in settlement negotiations. In addition to the money Evergrande has borrowed from 80,000 retail investors, the group owes other creditors and suppliers an estimated $300bn. In a statement at the weekend, Evergrande said that as of May 1 more than 40 group executives had purchased its investment products. Six of them, who had secured early redemptions of their investments, will return the money. “All funds redeemed by the managers must be returned and severe penalties will be imposed,” said the company, which has also offered to repay investors with discounted flats and parking lots. It is common for the owners and employees of heavily indebted Chinese companies to buy such products to help fund operations. Ding Yumei, wife of Evergrande founder and chair Hui Ka Yan, paid Rmb20m for group investment products in July.

Evergrande’s attempts to calm investor anger highlight the many challenges its debt crisis poses for the Chinese government, which is reluctant to bail out the company even though its collapse could have wide-ranging consequences. Some Evergrande bonds have recently traded as low as 20 cents on the dollar, while yields on other Chinese property groups’ debt have risen sharply. The value of Evergrande’s Hong Kong-traded shares have fallen almost 90 per cent over the past year.

The Chinese government recently organised a bailout of Huarong, a heavily indebted state-owned asset manager, by other government-controlled asset managers and banks. But it is reluctant to do the same for a large private-sector company such as Evergrande.

IMPACT: STRONGER DOLLAR. Volatility in GOLD | Panic based SELLING in Equities