Non Farm Payrolls Day: Spot Gold Analysis: XAUUSD: $1866/1836 or $1907/1926?

Fundamental Analysis | CMP $1875

Gold Price was observed capitalizing on an overdue correction in the US dollar on 04 May 2022, as the Fed poured cold water on aggressive tightening bets. Fed Chair Jerome Powell explicitly said Wednesday that the US central bank is not considering a 75 bps rate hike in June, sounding a less hawkish tone than markets had expected. The US Treasury yields also took a beating while the Wall Street indices gallops on a risk-on market profile. The dollar also felt the pain from reduced demand for safe havens, aiding the Gold Price rebound on 04 May 2022.

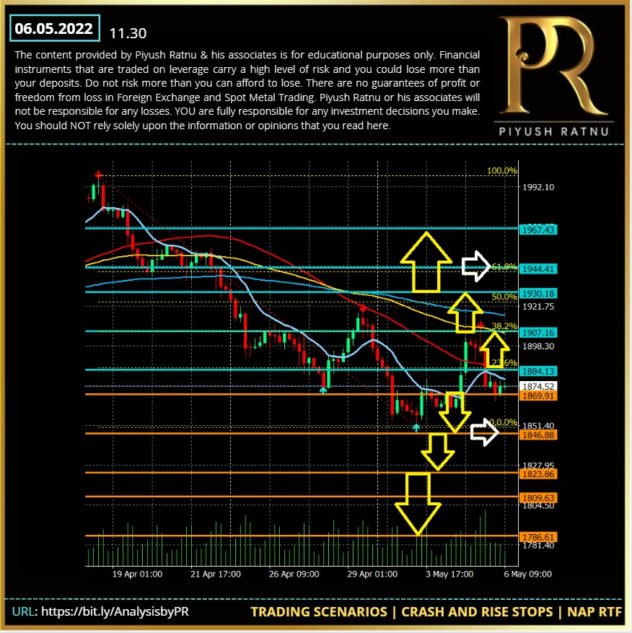

However on 05 May, 2022 Gold crashed from 1907 resistance zone till 1888 and extended the losses till 1866 today early morning. I had mentioned in my FOMC Day analysis the possibility of crash till 1866/1830 zone, after rejection from 1907/1926 zone. Though Gold reversed from 1907 zone, further crash till 1866 is indicating the next crash junction as 1836/1818 zone, in reversal we may see a repetition of the upwards price movement till 1888/1907/1926 zones in sequence.

Looking forward, the US Nonfarm Payrolls will offer fresh insights on the Fed’s forward guidance. In the meantime, the broader market sentiment and China’s covid lockdowns-led growth fears will continue to influence gold trades.

Dow tumbled 1,000 points for the worst day since 2020, Nasdaq drops 5%

Stocks pulled back sharply on Thursday, completely erasing a rally from the prior session in a stunning reversal that delivered investors one of the worst days since 2020. The Dow Jones Industrial Average lost 1,063 points, or 3.12%, to close at 32,997.97. The tech-heavy Nasdaq Composite fell 4.99% to finish at 12,317.69, its lowest closing level since November 2020. Both of those losses were the worst single-day drops since 2020.

The S&P 500 fell 3.56% to 4,146.87, marking its second worst day of the year. A common warning on Wall Street for a decade is that trading desks have been overrun by people who are too young to know what it’s like to navigate a Federal Reserve tightening cycle. They’re finding out now. 100% reversal of the gains within half a day is just truly extraordinary, and I alerted this in advance in my last analysis.

In markets, there’s turbulence, then there’s whatever you call the last two days, when a 900-point Dow rally was followed 12 hours later by a 1,000-point decline. Hundreds of billions of dollars of value are conjured and incinerated across assets in the space of a day lately, a stark reversal from the straight-up trajectory of the post-pandemic era.

Where once every dip was bought, now every bounce is sold. Thursday was only the fourth day in 20 years in which stocks and bonds each posted 2%-plus declines, going by major exchange-traded funds that track them. Concerted cross-asset stress of that magnitude reliably spurs speculation that big funds are being forced to sell.

We bought Gold at following price zones in last three days:

1862/1866/1875/1885 (1866/1888 S zone)

We sold Gold at following price zones in last three days:

1909/1907/1896 (1907 R zone)

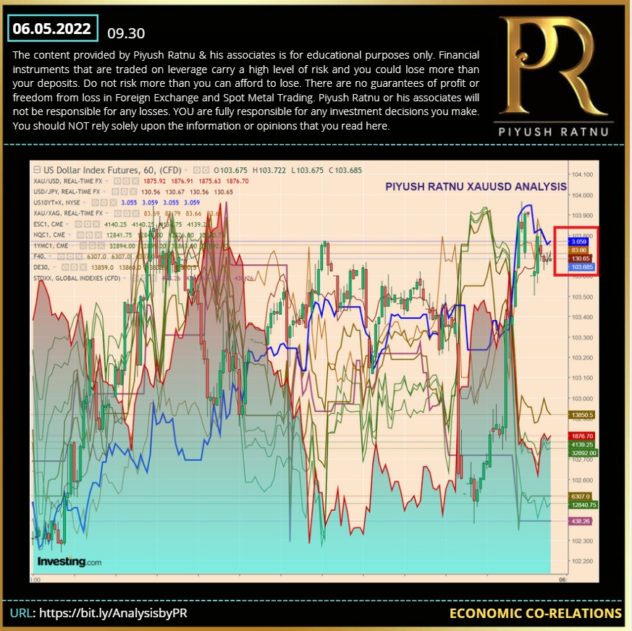

US 10 Year yields stand at 3.067, USDJPY at 130.51, XAUXAG ratio at 83.69 and Dollar Index at 103.780 at the time of writing.

How to trade on NFP data today?

Scenario A: Gold: $1836/1818/1777?

If the bearish momentum extends, gold price could fall further towards 1866/1836 (after 1846 S2) with 1818/1777 as final destination, if Gold crash halts at 1836 or 1818 zone a reversal can be expected with a RT 23.6 on M5 and M15 30% RT before/in next 10 days.

Scenario B: Gold: $1907/1926/1947?

If the Bullish momentum pushes Gold price across $1888 barrier, $1907 and $1926 can be the next target for Gold, opening way to $1947.

Heading into the NFP showdown today, gold price is lacking a clear directional bias, as investors are hesitant to place fresh bets due to ongoing saga of high volatility. The US NFP will emerge as the main market driver for gold price today.

Technical Analysis | CMP $1875

Gold Price – Key Indicators, Factors, Price Zones & SR Levels to watch:

| SMA | |

| H1 SMA50 | 1880.33 |

| H1 EMA100 | 1881.22 |

| H1 EMA200 | 1890.80 |

| H4 SMA50 | 1885.10 |

| H4 EMA100 | 1906.22 |

| H4 EMA200 | 1916.16 |

| Daily SMA50 | 1933.33 |

| Daily EMA100 | 1889.69 |

| Daily EMA200 | 1857.37 |

| SR ZONES | |

| R1 | 1884 |

| R2 | 1907 |

| R3 | 1930 |

| R4 | 1944 |

| R5 | 1967 |

| S1 | 1869 |

| S2 | 1846 |

| S3 | 1823 |

| S4 | 1809 |

| S5 | 1786 |

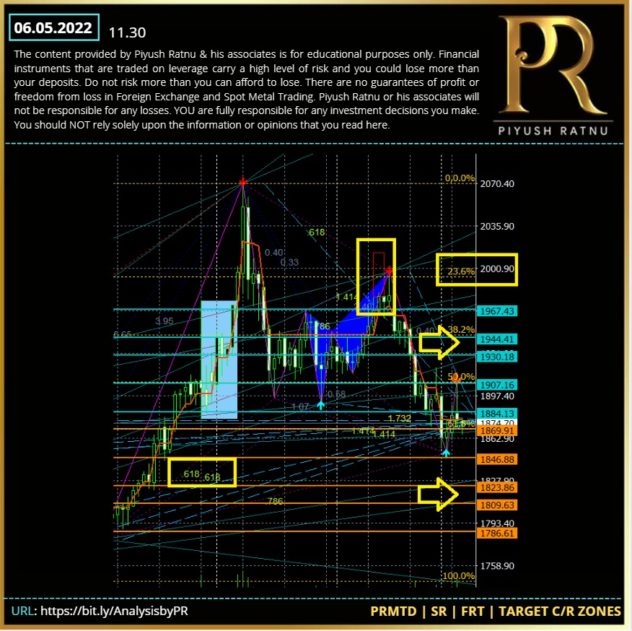

PRSR ZONE BASED TRADING SCENARIOS

Figure 1

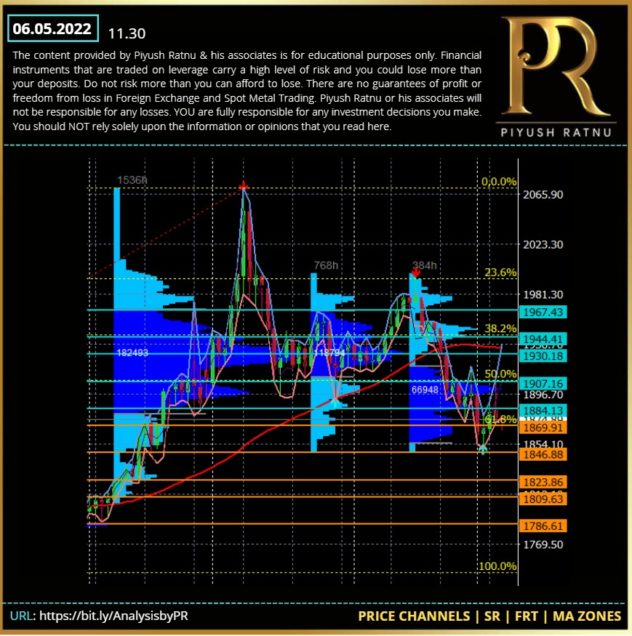

PRICE CHANNEL | PRTP BASED TRADING SCENARIOS

Figure 2

A break above $1907 after M1 M5 23.6 retracement format, might result in price trap of $1926-$1947 on a longer run and a further bullish trend might help GOLD bulls to achieve $1966. However a crash below $1866 might open gates for $1836 (after S2), $1818/1777 zone before retracement is achieved at 23.6 M5, M15/M30 in next 9 days.

TRADING STRATEGY:

Observe price at US OPENING SS1 and then US SS2

Observe S2-S3 zone and R2-R3 zone for reversals/retracement, Target NAP

Do not enter between the S/R zones or in pivot zone

Observe: FIB 23.6% on M1 and M5 for NAP target price

after 30/60/90/120 minutes of NFP

Price of Focus (POF)

Crash scenario:

S2 -6/9 RT NAP

S3 -3/6 RT NAP

S4 -6 RT NAP

Rise scenario:

R2+6/9 RT NAP

R3+3/6 RT NAP

R4+6 RT NAP

Implement RM till 30 after 15/30 min. and price gap 12/18/24 after NFP

Implement GR/SM after 24/40 price movement

Golden Ratio based money management should not be used at least till $18 price movement in any direction, if SM needs to be ignored.

Figure 3

Kindly observe the crucial limits/stops levels mentioned by me in this analysis in addition to possible crash and rise zones as mentioned in Figure 1 and 3.

Today, I will prefer to BUY session/daily lows below Support zone (-3/6/9 pattern) S2,S3 and S4, and I will prefer to SELL above Resistance zones 2 and 3 with a target of NET average profit, if fundamentals support and favour the same.

Movement of 24/45 or 60 dollars on Gold price is not something unexpected nowadays, and a surprise on Monday during early trading hours can not be ruled out too, so closing all positions today in net average profit is always the best trading strategy for every trader who wants to safeguard his principle.

BUY/SELL STOPS | BUY/SELL LIMITS: TARGET NAP ( Net Average Profit):

S2 ZONE 1846 | DOWN TREND (Below 1840) : 1836/1818/1800/1777 stops

R2 ZONE 1907 | UP TREND (After 1909) : 1916-1926-1947 stops

Read my analysis dated 04 May 2022 (FOMC Day) here: https://bit.ly/04MayAnalysisReviewPR

It is always wise to first PLAN THE TRADE, and then TRADE THE PLAN! Hence, it is suggested to first observe the crash or rise with specific zones and levels in mind on the basis of various fundamental and technical parameters mentioned above, before entering a trade in a specific direction with a target of net average profit in a specific set of trades.

WARNING: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The author will not be held responsible for information that is found at the end of links posted on this page. The author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. The author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author is not a registered investment advisor and nothing in this article is intended to be investment advice. All performance information reflects past performance and is presented on a total return basis. Past performance is no guarantee of future results. Current performance may differ from the performance shown.

RISK WARNING | DISCLAIMER

Information on this Channel/Page contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Information or opinions provided by us should not be used for investment advice and do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. When making a decision about your investments, you should seek the advice of a professional financial adviser.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

The analysis and trading suggestions published by Piyush Ratnu does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Piyush Ratnu does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Piyush Ratnu shall not be responsible under any circumstances for the consequences of such activities. Piyush Ratnu and its affiliates, in no event, be liable to users or any third parties for any consequential damages or losses in any direct or indirect manner, however arising, including but not limited to damages caused by negligence or Force Majeure whether such damages were foreseen or unforeseen.

The capital value of units in the fund can fluctuate and the price of units can go down as well as up and is not guaranteed. You should not buy a warrant unless you are prepared to sustain a total loss of the money you have invested plus any commission or other transaction charges. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals. The high degree of leverage can work against you as well as for you hence implement risk management and money management strictly to safeguard your investment. Do not risk more than .10% of your principle amount in a single trade set.

Before deciding to invest in foreign exchange or other markets you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some, or all, of your initial investment. Therefore, you should not invest money that you cannot afford to lose. In some cases, it is possible to lose more than your initial investment as it is not always possible to exit a market at the price you intend upon doing so. There are also risks associated with utilizing an Internet-based trade execution software application including, but not limited to, the failure of hardware and software. You should be aware of all the risks associated with investing in foreign exchange, indices and commodities and seek advice from an independent financial advisor if you have any doubts.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions. Piyush Ratnu or his associates will not accept any liability for any loss or damage, including but without limitation to, any financial, emotional loss, which may arise directly or indirectly due to your decision. If you do not agree to the above terms, conditions and disclaimer YOU MUST leave this group with immediate effect and YOU MUST not act as per the information provided in this document.