Gold Price rebounds as $ correction phase begins

Read my analysis dated 04 May 2022 (FOMC Day) here.

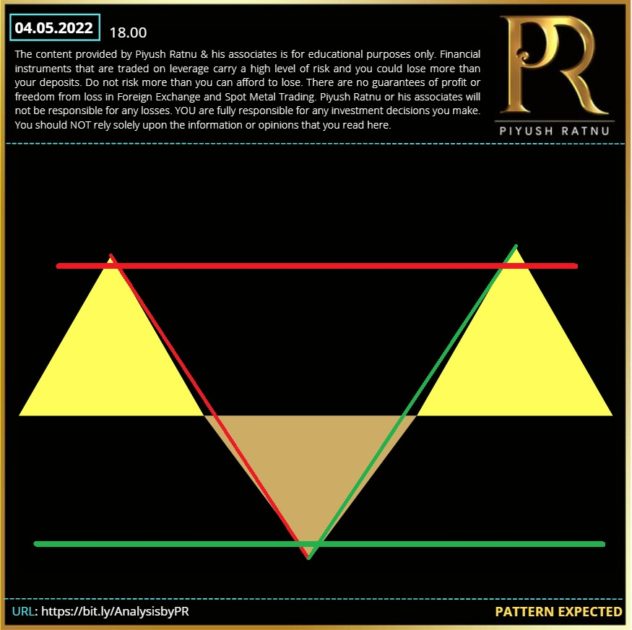

Yesterday, I alerted in my analysis the following pattern for traders:

Key Highlights for today:

Gold Price is capitalizing on an overdue correction in the US dollar, as the Fed poured cold water on aggressive tightening bets. Fed Chair Jerome Powell explicitly said Wednesday that the US central bank is not considering a 75 bps rate hike in June, sounding a less hawkish tone than markets had expected. The US Treasury yields also took a beating while the Wall Street indices gallops on a risk-on market profile. The dollar also felt the pain from reduced demand for safe havens, aiding the Gold Price rebound. Looking forward, the US Nonfarm Payrolls will offer fresh insights on the Fed’s forward guidance. In the meantime, the broader market sentiment and China’s covid lockdowns-led growth fears will continue to influence gold trades.

Technical:

GOLD approaching D1E1 CMP above H1E2 M5S5

M15 S5 E1 | M30 S5E1E2 | H1 E2 E2 S5 in sequence as next crash stops

(after rejection from 1907/1917-1926 zone)

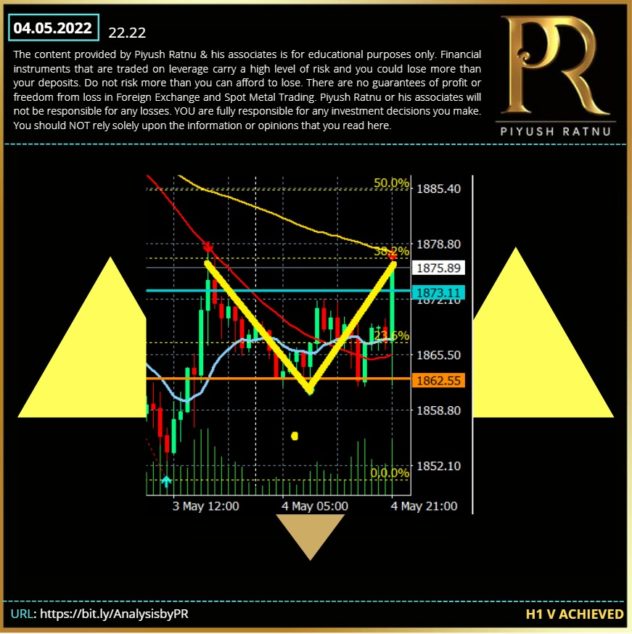

1866 proved a major support yesterday, immediate FRT to 1888/1907 was well observed just like last week. V pattern completed: as alerted in my analysis dated 04 May 2022.

Formation of A pattern in process.

RT pattern

M15/M30 S5 might be next stops

SR Pattern

Currently at R2

+/-6: R2/R3 crucial zone for S entries

Crucial Stops:

GOLD still struggling to hold 1900 psychological level

As alerted in earlier posts, heavy selling below 1866 was observed

Result: Retail Traders lost

Today, 1907/1926 looks as rise stop | 1888-1866 well established as crash stops

06.05.2022: NFP: STAY ALERT

RTFIB

The Fibonacci 23.6% one-week at $1,888 zone will be on the sellers’ radars If the pullback gathers steam.

Today my POF will be selling above R2/R3 (above mentioned) zones, in case of reversal: buying below 1888-1866 (S1/S2 -6/9)

TARGET NAP

Currency Strength

ÜSD 75

JPY 40

AUD 23

CAD 85

EUR 61

GBP 20

Fundamental:

A sudden UP rally is quite possible due to uncertainty + Russia-Ukraine related statements | NFP Data might trigger HV event tomorrow at 16.30, it will be wise to avoid heavy lots, and will be worth waiting for NFP data based rally, considering yesterday ADP NFP was negative.

BOE Inflation Report

BOE Interest Rate today: 15.00 hours

Volatility of $6-10 expected, US pre opening pressures might add more volatility at 16.30 hours

Important Dates:

06 May 2022

A sudden trigger + rally in JPY possible on or before 12 May 2022 (completion of Market cycle M1, and earning season results + BOND BUYING cut off)

DXY 102.688 RT phase

US 10YT 2.940

USDJPY 129.40

XAUXAG 82.22

As alerted in advance:

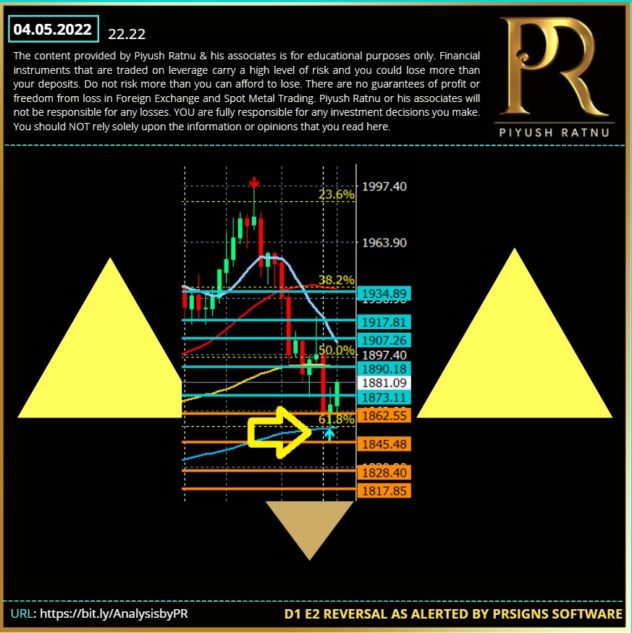

After hitting the strong support zone of 1866, with a low at 1862 S zone, GOLD reversed furiously towards 1888/1907 zones, and was well alerted by me in advance as the rise stops: Gold struggled well at 1888 zone, before marching towards 1907 zone, CMP 1901, today’s high 1903

V pattern after completion of A pattern on M30 H1 H4 was well achieved yesterday with stops at 1888 followed by R2 + 6= 1896, and 1907 R zone.

In addition D1E2 and D1618 proved to be major support for GOLD price and I alerted well in advance quoting this level as RT zone.

As quoted yesterday: The next upside target for buyers is envisioned $1,907/1926.

In addition, I also alerted on 27 April 2022: Dramatic rallies are on the way, APRIL end + first week of MAY always have been volatile for GOLD traders considering Rate Hike policy, NFP and monetary policy related statements on the way.

In addition, I also alerted on 27 April 2022: Dramatic rallies are on the way, APRIL end + first week of MAY always have been volatile for GOLD traders considering Rate Hike policy, NFP and monetary policy related statements on the way.

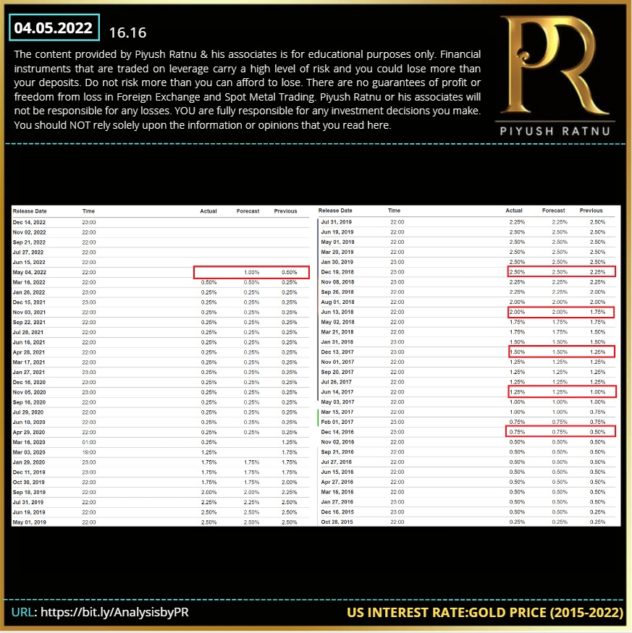

Analytical explanation of the above: based on the price movement in GOLD on and after the rate hikes:

2016

Date of Hike: 14 Dec. 2016

XAUUSD on 01 Dec 2016: $1170

XAUUSD on 14 Dec. 2016: $ 1125

XAUUSD on 14 Jan. 2017: $1190

XAUUSD on 14 March 2017: $1188

Pattern traced: V extension in 90 days

2017

Date of Hike: 14 June 2017

XAUUSD on 01 June 2017: $1290

XAUUSD on 14 June 2017: $1240

XAUUSD on 14 July 2017: $1258

XAUUSD on 14 Sept. 2017: $1346

Pattern traced: V extension in 90 days

Date of Hike: 13 December 2017

XAUUSD on 01 December 2017: $1280

XAUUSD on 14 December 2017: $1236

XAUUSD on 14 January 2018: $1330

XAUUSD on 14 March. 2018: $1303

Pattern traced: V extension, A 30RT in 90 days

Date of Hike: 13 June 2018

XAUUSD on 01 June 2018: $1290

XAUUSD on 14 June 2018: $1279

XAUUSD on 14 July 2018: $1247

XAUUSD on 14 Aug. 2018: $1160 (year low)

XAUUSD on 130 Nov. 2018: $1260

Pattern traced: V pattern in 150+ days

Date of Hike: 19 December 2018

XAUUSD on 01 December 2018: $1230

XAUUSD on 19 December 2018: $1273

XAUUSD on 19 January 2018: $1300

XAUUSD on 14 March. 2018: $1330

Pattern traced: V extension in 90 days $100

Date of Hike: 05 May 2022

XAUUSD on 01 May 2022: $1903

XAUUSD on 05 May 2022: $1890 (after FOMC) RT from S1 1862 (1866 zone)

XAUUSD on 06 May 2022: $1907

XAUUSD on 20 May 2022:

Pattern traced: V extension in 90 minutes after Fed Rate Decision and during FOMC